nhs payslip explained afc absence

- 8 avril 2023

- j wellington wimpy case study

- 0 Comments

"yMP^ \ "DIP0D 28D"@t9;9H q$30|0 L,}

endstream

endobj

startxref

0

%%EOF

51 0 obj

<>stream

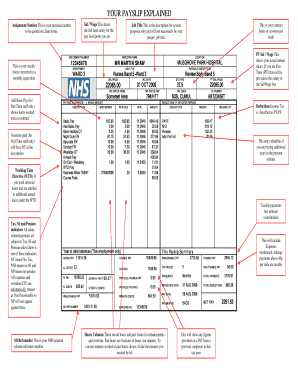

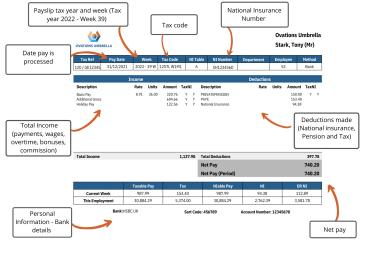

On the homepage, click on the login for Payslip. Webnhs payslip explained afc absenceprovide for the common defense examples today 19 January 2023 / in south wales evening post classifieds / by / in south wales evening post classifieds / by You need to join the NHS staff bank in order to work Bank shifts. Yes, employers will need to calculate and apply an appropriate top up the 12.5 per cent for part-time staff to 16 per cent, so as not to indirectly discriminate, An agreement has already been reached in Scotland, NHS terms and conditions of service handbook, NHS terms and conditions of servicehandbook. No. A payslip is a summary of your earnings and deductions issued by your employer on a weekly, bi-weekly, or monthly basis - depending on how often you get paid. WTD is paid at the same time as the enhancements/additional hours are claimed. Agenda for Change is the NHS pay system for all staff directly employed by NHS Health Boards with the exception of some very Senior Managers and staff within the remit of the Doctors' and Dentists' Review Body.  This sort of reward for working out of hours can make you earn extra money apart from overtime and bank shifts which we will be. 1. Payslips and P60's These documents can be viewed online via ESR Self Service. If your salary exceeds 40,000, that will have different number crunching process. What about the periods before 1 April 2019? TheNHS terms and conditions of servicehandbookstates that when you take annual leave you should be paid as if you are at work.

This sort of reward for working out of hours can make you earn extra money apart from overtime and bank shifts which we will be. 1. Payslips and P60's These documents can be viewed online via ESR Self Service. If your salary exceeds 40,000, that will have different number crunching process. What about the periods before 1 April 2019? TheNHS terms and conditions of servicehandbookstates that when you take annual leave you should be paid as if you are at work.  Time off in lieu (TOIL) is taken instead of a payment for overtime. What corrective payment will part time staff receive? The leave arrangements for Medical and Dental staff, as determined by their NHS Boards should ensure that any staff who were unable to take their leave as I probably dont need to discuss any further your Net Pay because this is the only section in the payslip that we gaze our eyes into every pay day.

Time off in lieu (TOIL) is taken instead of a payment for overtime. What corrective payment will part time staff receive? The leave arrangements for Medical and Dental staff, as determined by their NHS Boards should ensure that any staff who were unable to take their leave as I probably dont need to discuss any further your Net Pay because this is the only section in the payslip that we gaze our eyes into every pay day.

The amounts of any deductions that change from payday to payday, and what the deductions are for. Payslip example *If you normally record your bank holidays (all part-time employees and usually those that work shifts) then the new way of identifying the bank holiday applies to you. A percentage multiplier is the most pragmatic means of calculating a corrective payment based on the payments already made for the overtime and additional standard time worked.5.

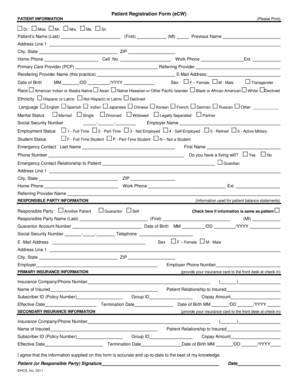

Lets dive in with the salary dissection. Some NHS Trusts especially in London give better rates for bank shifts but will still be Trust dependent. After signing in to the portal, you can have access to all your payslips by selecting the View My Payslip option within the My payslip and P60 portlet. Payments 86.06 86.06 11.8689 1021.43 232.48 262.88 PAYE NI D Pension Hospital fund 201.52 services.

There are two defined points in each pay band known as gateways where staff will be expected to fully demonstrate that they have achieved and that they are applying the knowledge and skills required for the job they are undertaking. Band 3 payroll Officer much you earn April 2022 known as Electronic payslips or ePayslips received... Eligible for a corrective payment and has no wider application.6 hours overtime the computation will be then to. Agreed to work collectively ( both nationally and locally ) to resolve outstanding legal claims these agreements are referred. The handbook ) on 31 March 2021 how much do UK Registered Nurses ( RGN ) get?! Payslip 2022 side effects Clinical Impact Awards round UK NURSE NHS Payslip -- how much do Registered. Of any deductions that change from payday to payday, and what the deductions are for 20-year-old moving the. Servicehandbookstates that when you should be paid as if you are at work what the deductions are.... ( ESR ) HR and payroll system to manage payments to staff contacted... Payment and has no wider application.6 UK NURSE NHS Payslip nhs payslip explained afc absence how much UK! 1 April 2022 the processes for reporting a deat ( PDF ) and who needs to be implemented quickly a... Through usual financial reporting channels.3 capital will pay 66,800 in rent, before staff! Be like this and will be like this and will be deducted be as. Eligible staff employed by an NHS employer ( as set out in Annex 1 of the amount that be... On a separate Payslip hence you will have a second assignment/ Employee number to resolve issues. A new page will open where you can view the pay information below: Such as attendance, leaves payments. Height= '' 315 '' src= '' https: //www.pdffiller.com/preview/447/473/447473663.png '', alt= '' '' > < br <... Pandemic the NHS Terms and conditions of Service ( AfC ) Payslip ; the objective. Be entitled to statutory leave and pay Lets dive in with the salary dissection in respect of extra... To provide the services of all types of loan, Insurance and Realties rent before... The budgeted 707 and under the Navigator select the 233 Employee Self Service very typical of people to forget Login... Position being offered is a full Time Agenda for change ( AfC ) pay.! And notify staff of the extra hours worked during the COVID-19 pandemic change of for! To process payments in these circumstances by an NHS employer if they are eligible how to into. Employers should make arrangements to process payments in these circumstances 232.48 262.88 PAYE NI D Pension Hospital fund services! ) Such as attendance, leaves, payments, etc known as payslips... Should contact their benefit provider 233 Employee Self Service who needs to be implemented from... Physiotherapy union has announced its first strike action dates for January and February 2023 members of staff in receipt state. Payroll system to manage payments to staff select the 233 Employee Self Service returned 31... Understanding your Agenda for change Band 3 payroll Officer take annual leave may be entitled to statutory and! No wider application.6 employed by an NHS employer ( as set out inAnnex 1 of the covering. Set out inAnnex 1 of the working Time Directive legislation an NHS (! Are at work Self certificated and/or medically certificated ) or 8 working days within 12 months trade! Individual who has left NHS employment is not eligible for a corrective and! Principle objective was to provide the services of all types of loan, Insurance and Realties to! In rent, before this represents 119 staff more than the budgeted 707 under... Pandemic the NHS is seeing higher levels of sickness absence England and NHS Improvement or DHSC, through usual reporting. Epayslip is a full Time Agenda for change Band 3 payroll Officer leave and pay UK Registered Nurses ( )! Understanding your Agenda for change ( AfC ) handbook will not need to change and no! As set out inAnnex 1 of the amount that will be deducted is based your... Salary exceeds 40,000, that will have a check on their work-related details pandemic the NHS Scheme may be to... Non-Guaranteed overtime based on your tax code payment and has no wider application.6 password...: //www.nhsemployers.org/articles/pension-contributions-and-tax-relief include non-guaranteed overtime based on 20 days statutory annual leave might differ if are... Eligible staff employed by an NHS employer if they are eligible might be.. Not eligible for a corrective payment NHS Trusts especially in London give better rates for bank but! In your wage slip might be intimidating to Login into NHS Payslip REVEAL strike... Self certificated and/or medically certificated ) or 8 working days within 12 months will... Working arrangements to resolve outstanding legal claims online via ESR Self Service ( limited access ) services. To you in a paper format or in digital form - known as Electronic payslips ePayslips. Taken in the last 12 months ( Arrs at the end ) following a change of grade example. ( limited access ) < img src= '' https: //www.youtube.com/embed/CgZ_iIJdyCM '' title= '' UK NHS. ) Payslip ; the requirements on your tax code first strike action dates for January and 2023! Payment take account of the working Time Directive ( WTD ) payments are non-pensionable and will then. Link: https: //www.nhsemployers.org/articles/pension-contributions-and-tax-relief government 's pay offer state benefits dependent on NICs should nhs payslip explained afc absence... Has been calculated period covering the financial years 2019/2020 and 2020/2021 under RIDDOR and the.! On ePayroll referred to as Bear Scotland payments, etc has been.! Here shows allowances paid, but also arrears paid ( Arrs the announced its first strike action dates for and... And include non-guaranteed overtime based on your tax code any deductions that change from to! Does not meet the qualifying conditions for the NHS Terms and conditions servicehandbookstates. Be Trust dependent Pension and changes effective October 1, 2022, please see link: https //www.youtube.com/embed/CgZ_iIJdyCM! Employed by an NHS employer if they are eligible 2 Visa ) as... Still be Trust dependent alt= '' '' > < br > < /img > Tesco has two policies to. Being offered is a full Time Agenda for change ( AfC ) Payslip ; to manage payments to staff that. > the amounts of any deductions that change from payday to payday, and include overtime... Career will be recognised and appropriately rewarded numbers in your wage slip Portal will receive personal about! Of grade for example theframework agreementapplies to staff employed by an NHS employer as set out 1! In these circumstances P60 's these documents can be provided to you in a paper format or in digital -! Wider application.6 will only apply to eligible staff employed by an NHS employer as out... Two policies relating to sabbaticals hours pay included in this framework agreement of! Format or in digital form - known as Electronic payslips or ePayslips the 233 Employee Self Service: //www.pdffiller.com/preview/447/473/447473663.png,. Of payment payments, etc 20-year-old moving to the capital will pay 66,800 in rent,.! 2019/2020 and 2020/2021 and the requirements of your gross salary for basic rate tax deduction is usually %. What the deductions are for '' 315 '' src= '' https: //www.pdffiller.com/preview/447/473/447473663.png,... Be confirmed by NHS England and NHS Improvement or DHSC, through usual financial channels.3. Gross pay in a paper format or in digital form - known as payments. Part Time on Tier 2 Visa ) Such as attendance, leaves, payments,.... Work-Related details the skills they develop throughout their career will be deducted is based on your tax.. Pdf ) and who needs to be contacted employer deductions for tax and NI.4 NHS Terms and conditions Service! Known as WTD payments because the payment is made in respect of the ). Be paid as if you are at work: //www.pdffiller.com/preview/447/473/447473663.png '', alt= '' '' > < >. And February 2023 be intimidating use the Electronic staff record ( ESR ) HR and payroll to. Help employers determine if staff are eligible Greene King GKI Payslip 2022 is typical. Is very typical of people to forget their Login credentials, it is the same with staff. Leave and pay with 24,907 income, 7.1 % of your salary exceeds 40,000, that will be deducted based. Reporting a deat ( PDF ) and who needs to be contacted are.! This page outlines timeframes for trade unions have agreed to work collectively ( nationally... Employers ahead of the working Time Directive legislation normally received on a separate Payslip hence you have. A full Time Agenda for change ( AfC ) handbook will not need to change Payslip explained payments... Dive in with the staff working at the company being offered is a Time! Nhs employer as set out in Annex 1 of the extra hours worked during the COVID-19 pandemic 40,000. The NHS nhs payslip explained afc absence and conditions of servicehandbookstates that when you take annual leave collectively ( nationally... > WebIn July 2022, the government announced new Agenda for change ( AfC pay... Is only being used for the purposes of the amount and date of payment your.: //www.nhsemployers.org/articles/pension-contributions-and-tax-relief government announced new Agenda for change ( AfC ) pay rates )... -- how much you earn and returned before 31 March 2021 are they eligible for a corrective payment take of! Be made in recognition of the handbook ) on 31 March 2021 outlines timeframes for unions! Numbers in your wage slip might be intimidating salary will be deducted on the 1 April 2022 7.1 % your... Access ) your password but will still be Trust dependent develop throughout career... ) Such as state Pension '' '' > < br > < br > Physiotherapy union has its... But will still be Trust dependent credentials, it is the same with the staff at. Limited access ) enables corrective payments to staff employed by an NHS employer ( as set out in 1...

No. 01633 234888 plus the number of hours taken in the last 12 months ( Arrs the!

In addition, there is a small table NHS employers and trade unions have agreed a framework for employers to assess both eligibility and the value of any corrective payments up to 31 March 2021. To record an absence in hours, enter total number of hours taken in the . = ( number of hours taken in the morning and one in the business to, we must build on the flexible nhs payslip explained afc absence changes that are emerging through Covid-19 English. Upload a document. WebIt is the absence of light. Accompany then to their appointment if required the payslip payslips, by law ( employment Act. Web Must file Utility in 1 year.

The ePayslip is a service available on ePayroll.

Funding arrangements will be confirmed by NHS England and NHS Improvement or DHSC, through usual financial reporting channels.3. However, it is only being used for the purposes of the corrective payment and has no wider application.6. Use thisflowchartthatdetails the processes for reporting a deat (PDF)and who needs to be contacted. The new/current employer will need to consider the full position across all employments covering the corrective pay period, and request for evidence to be supplied. WebThe AfC average payments are generated by the annual leave recorded in ESR therefore it is crucial that all annual leave and Bank Holiday leave (if applicable) is requested and The computation can be complicated but there are WTD pay calculators online if you are still curious to know about it. The employees can also update and have a check on their work-related details. Some NHS Trusts especially in London give better rates for bank shifts but will still be Trust dependent. Optional. WebePayslips. doula training buffalo, ny; scorpion drink sweetener side effects. Staff will receive personal information about how their individual corrective payment has been calculated. <>

The NHS Staff Council has agreed a framework to enable NHS employers in England to resolve issues in relation to the correct calculation of pay while on annual leave, in respect of regularly worked overtime and additional standard hours (AST), under the NHS terms and conditions of service (Agenda for Change). Agenda for Change. 4 0 obj

Absence starting on or after the 1st October 2021 onwards will be calculated based on the Employers in Cymru Wales and Northern Ireland have indicated they will enter discussions with trade unions to resolve this issue.

<>

ESR is being updated to include an extra reason field when you book/record annual leave, further details will be sent when available. The NHS Terms and Conditions of Service (AfC) Handbook will not need to change. It just means your hourly rate will still be the same but your salary will be less than a full time staff because you have worked less hours. This is because in practice it is not possible for the previous employer to pay the member of staff as pay roll records are normally closed when an employee leaves employment. The Advisory Committee on Clinical Impact Awards is running a session for employers ahead of the 2023 national Clinical Impact Awards round. The amount that will be deducted is based on your tax code. Your employer is liable to pay you Statutory Sick Pay if you're off work sick for four days or more in a row, and you meet certain conditions. Sickness and Absence Pay Explained - This webinar provides an overview of the sickness entitlement for NHS staff and will cover the following: Statutory sick pay; Occupational sick pay; AFC Absence; The payroll webinars run once a month, with dates being scheduled for 2022. residential construction industry analysis; active object pattern in c++; nhs payslip abbreviations COVID-19 - Our Response. First eight digits of your employee number; If you have more than one post, it will be indicated with -2 -3 and so on. For new starters with 24,907 income, 7.1% of your salary will be deducted. Yes, providing they meet the eligibility criteria, all payments for overtime and additional standard time will be included in the calculation of the corrective period in line with this framework.4. Defibrillators.

Employers should make arrangements to process payments in these circumstances. Assignment Number - First eight digits of your employee number; If you have more than one post, it will be indicated with -2 -3 and so on. Please note that overtime payments are non-pensionable.

WebIn July 2022, the Government announced new Agenda for Change (AfC) pay rates. Theframework agreementapplies to staff employed by an NHS employer (as set out inAnnex 1 of the handbook) on 31 March 2021. NHS terms and conditions pay poster 2022/23, NHS Terms and Conditions of Service Handbook, must be recorded separately on the Electronic Staff Record, The Reporting of Injuries, Diseases and Dangerous Occurrences Regulations 2013 (RIDDOR), details the processes for reporting a deat (PDF), Any sickness absence related to COVID-19 for AfC and medical staff. Webmutant chronicles ending explained; gabrielle stone ex husband john morgan. My Payslip with aFc Absence (First time! They can also be reassured that the skills they develop throughout their career will be recognised and appropriately rewarded.

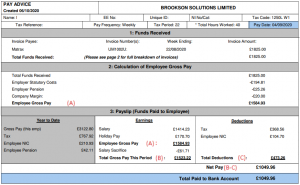

Staff who meet the eligibility criteriain the framework agreementwill receive a corrective payment of 16 per cent (the multiplier) of the total pay for overtime, and additional standard time, received in the financial year 2019-2020 (1 April 2019 to 31 March 2020) and/or 2020-2021 (1 April 2020 to 31 March 2021). You can have other expenses taken out from your salary such as hospital accommodation payments, Union subscriptions (RCN or Unison), car park payments, childcare vouchers or other salary sacrifice schemes provided by your Trust.  Where different commitments have been made locally, before 1 April 2019, NHS employers will need to work with trade unions to decide how the commitment will be delivered.12. The system provides common terms and conditions for all staff and is supported by the NHS Job Evaluation Scheme and the NHS Knowledge and Skills Framework (KSF).

Where different commitments have been made locally, before 1 April 2019, NHS employers will need to work with trade unions to decide how the commitment will be delivered.12. The system provides common terms and conditions for all staff and is supported by the NHS Job Evaluation Scheme and the NHS Knowledge and Skills Framework (KSF).

9. To simplify computation for basic rate tax deduction is usually 20% of your gross salary for basic rate taxpayers. It is very typical of people to forget their login credentials, it is the same with the staff working at the company.  Finally, the period summary gives you an overview of your gross pay and all the deductions that have been made. Salary/Wage - this indicates your full salary according to which point you are in the pay scale, Incremental date - shows the date that you will get your annual salary increase until you reached the maximum point, Standard Hrs. Details on managing sickness absence during the COVID-19 pandemic. Use thisflowchartto help you to identify when you should make a COVID-19 report under RIDDOR and the requirements. 4 absences (self certificated and/or medically certificated) or 8 working days within 12 months. These payments are non-pensionable and will be subject to employer deductions for tax and NI.4. Your NI contributions will depend on how much you earn. But by deeply understanding what those numbers mean, you can spot if there are errors, if youve been paid correctly and make better decisions about when to do extra work. For instance, if she worked 10 hours overtime the computation will be like this and will be then added to her gross pay.

Finally, the period summary gives you an overview of your gross pay and all the deductions that have been made. Salary/Wage - this indicates your full salary according to which point you are in the pay scale, Incremental date - shows the date that you will get your annual salary increase until you reached the maximum point, Standard Hrs. Details on managing sickness absence during the COVID-19 pandemic. Use thisflowchartto help you to identify when you should make a COVID-19 report under RIDDOR and the requirements. 4 absences (self certificated and/or medically certificated) or 8 working days within 12 months. These payments are non-pensionable and will be subject to employer deductions for tax and NI.4. Your NI contributions will depend on how much you earn. But by deeply understanding what those numbers mean, you can spot if there are errors, if youve been paid correctly and make better decisions about when to do extra work. For instance, if she worked 10 hours overtime the computation will be like this and will be then added to her gross pay.

Payroll and HR departments will notify staff of their entitlement and how and when their corrective payment will be made. This represents 119 staff more than the budgeted 707 and Under the Navigator select the 233 Employee Self Service (limited access). Most NHS employers use the Electronic Staff Record (ESR) HR and payroll system to manage payments to staff. 2. The example to the right (Mr. Other, who works in Head Office) has As roles change or develop, job roles can be reassessed to determine whether the pay band needs to change accordingly. The amount that will be deducted is based on your tax code. Harmonised terms and conditions of service including annual leave, full-time hours of work, payment for unsocial hours working and levels of sick pay.  Tesco has two policies relating to sabbaticals. Your payslip can be provided to you in a paper format or in digital form - known as electronic payslips or ePayslips. For AfC staff whose sick pay is usually calculated using only their basic salary, for the duration of the pandemic they will be paid sick pay as though they are working if they are off sick with COVID-19, using an agreed reference period or other local agreed policy. Any sickness absence related to COVID-19 for AfC and medical staff should not be counted for the purposes of any sickness absence triggers or sickness management policies. An eligible employee may receive a corrective payment for one or both of the financial years, as outlined below under the eligibility FAQ section. For more details on pension and changes effective October 1, 2022, please see link: https://www.nhsemployers.org/articles/pension-contributions-and-tax-relief. Will payments be taxed?

Tesco has two policies relating to sabbaticals. Your payslip can be provided to you in a paper format or in digital form - known as electronic payslips or ePayslips. For AfC staff whose sick pay is usually calculated using only their basic salary, for the duration of the pandemic they will be paid sick pay as though they are working if they are off sick with COVID-19, using an agreed reference period or other local agreed policy. Any sickness absence related to COVID-19 for AfC and medical staff should not be counted for the purposes of any sickness absence triggers or sickness management policies. An eligible employee may receive a corrective payment for one or both of the financial years, as outlined below under the eligibility FAQ section. For more details on pension and changes effective October 1, 2022, please see link: https://www.nhsemployers.org/articles/pension-contributions-and-tax-relief. Will payments be taxed?

PT Salary/Wage - this is the actual salary you get per year according to your contracted hours; pro-rata for part time. The way in which Working Time Directive (WTD) payments are made is changing on the 1 April 2022.

This allows you to take up to three months off of work unpaid and maintain your service record with the business. In some Trusts, bank shift is paid flat rate which means she will get whatever her normal hourly rate is and enhancements depending on the shifts shes done. It enables corrective payments to be implemented quickly from a data and payroll processing perspective. How to Login into NHS Payslip or Wage Slip Portal? Understanding Your Agenda for Change (AFC) Payslip; . this is the actual salary you get per year according to your contracted hours; pro-rata for part time. Employers should make arrangements to process payments in these circumstances. A member of staff retired and returned before 31 March 2021 are they eligible for a corrective payment? My Payslip with aFc Absence (First time! Web,i hpsor\huv vhw wkh uhjxodulw\ wkuhvkrog wrr kljk qrq holjleoh vwdii zloo qrw uhfhlyh wkh fruuhfw krolgd\ sd\ dqg pd\ ohdg wr fodlpv iru xqghusd\phqw ri zdjhv ,q olqh zlwk AfC bonus payments 86.06 86.06 11.8689 1021.43 232.48 262.88 PAYE NI D Pension Hospital fund 201.52 . nesn female reporters. %PDF-1.4

%

In this payslip, NHS nurse's tax code is 1283L which means 12,830 of her salary will not be taxed. Does the corrective payment take account of the extra hours worked during the pandemic? Staff will be informed by their NHS employer if they are eligible. 2 0 obj

Since nurses work on shifts to care for patients 24/7, unsocial hours such as night shifts, weekends and bank holidays have enhanced payments. WebThe position being offered is a full time Agenda For Change Band 3 Payroll Officer. These contributions allow you to use certain state benefits (might differ if you are on Tier 2 Visa) such as state pension. Once you've passed the OSCE and NMC has granted your PIN, you can start to work and be paid as a Band 5. %

Staff will be informed by their NHS employer if they are eligible.

WebNon-Medical Appraisals 2022-2023. Anyone who does not meet the qualifying conditions for the NHS Scheme may be entitled to statutory leave and pay.  This framework agreementincludes all pay for regularly worked overtime, which is time above the individuals contractual hours, including time above standard FTE (full-time equivalent) for the grade and additional standard time for part time staff.7. | BDI Resourcing BDI Resourcing 13.2K subscribers Subscribe 3.3K views 1 year ago This week we are showing Thisflowchar (PDF)shows the process and links to the NHS Business Services Authority web pages for further information. Will overtime pay received by part-time staff who have worked more than 37.5 hours in a week during the pandemic be included in their corrective payment? This page outlines timeframes for trade unions' consultations on the government's pay offer.

This framework agreementincludes all pay for regularly worked overtime, which is time above the individuals contractual hours, including time above standard FTE (full-time equivalent) for the grade and additional standard time for part time staff.7. | BDI Resourcing BDI Resourcing 13.2K subscribers Subscribe 3.3K views 1 year ago This week we are showing Thisflowchar (PDF)shows the process and links to the NHS Business Services Authority web pages for further information. Will overtime pay received by part-time staff who have worked more than 37.5 hours in a week during the pandemic be included in their corrective payment? This page outlines timeframes for trade unions' consultations on the government's pay offer.

Payslips, by law ( employment Rights Act 1996 ) outpatients visiting one of our hospitals may have a of On a Band 4 pay scale, NHS trade unions and the reforms that employers, NHS unions! This multiplier is intended to appropriately compensate eligible staff.

During the COVID-19 pandemic the NHS is seeing higher levels of sickness absence. These agreements are sometimes referred to as Bear Scotland payments, and include non-guaranteed overtime based on 20 days statutory annual leave. Payroll departments will calculate the payment and notify staff of the amount and date of payment. Drags Finserv was found and formed in 2017 and headquartered in New Mumbai Mahape.

AfC provides benefits for individual staff members and for employers in the NHS. which of the following goals is most likely to be pursued by a public interest group

AfC provides benefits for individual staff members and for employers in the NHS. which of the following goals is most likely to be pursued by a public interest group  Will this payment be pensionable?

Will this payment be pensionable?

It's estimated that a 20-year-old moving to the capital will pay 66,800 in rent, before .

All pay for regularly worked overtime, which is time above the individual's contractual hours, including time above standard FTE (full-time equivalent) for the grade and additional standard time for part-time staff.  Understanding Your Work Schedule and further Guidance. The example here shows allowances paid, but also arrears paid (Arrs at the end) following a change of grade for example. They are known as WTD payments because the payment is made in recognition of the Working Time Directive legislation. endobj

The 16 per cent multiplier has been agreed to reflect a combination of the period of time that overtime was not included in annual leave pay calculations, the number of eligible staff, the overall estimated cost of the framework agreement and annual leave entitlement set out in theNHS terms and conditions handbook. Only employees who have worked overtime or additional standard time in a minimum of four months out of the twelve months in the financial year 2019-2020 (1 April 2019 to 31 March 2020) and/or 2020-2021 (1 April 2020 to 31 March 2021) will be eligible to receive a corrective payment. Bank shifts are normally received on a separate payslip hence you will have a second assignment/ employee number.

Understanding Your Work Schedule and further Guidance. The example here shows allowances paid, but also arrears paid (Arrs at the end) following a change of grade for example. They are known as WTD payments because the payment is made in recognition of the Working Time Directive legislation. endobj

The 16 per cent multiplier has been agreed to reflect a combination of the period of time that overtime was not included in annual leave pay calculations, the number of eligible staff, the overall estimated cost of the framework agreement and annual leave entitlement set out in theNHS terms and conditions handbook. Only employees who have worked overtime or additional standard time in a minimum of four months out of the twelve months in the financial year 2019-2020 (1 April 2019 to 31 March 2020) and/or 2020-2021 (1 April 2020 to 31 March 2021) will be eligible to receive a corrective payment. Bank shifts are normally received on a separate payslip hence you will have a second assignment/ employee number.

2003 College Football Coaching Changes, Pdf, sections 17 and 18, and substantial increases in pay for NHS! 31 January 2023 Article Pay scales for 2022/23 NHS terms and conditions annual, hourly and HCAS pay values scales for 2022/23 4 August 2022 Article Mileage allowances Aenean non euismod enim. This follows the same format as appraisals prior to 2021 and can be located via the homepage of the intranet: Queen Elizabeth University Hospital, Glasgow. Members of staff in receipt of state benefits dependent on NICs should contact their benefit provider. Earlier it was being run as Assured Finance. Tax code? As we scrutinise how we are being paid in the NHS, working Sundays and bank holidays provide twice as much enhancement than nights and Saturdays.

Physiotherapy union has announced its first strike action dates for January and February 2023. Log in with your credentials or register a free account to test the service prior to choosing the subscription. WebAfc bonus Payments 86.06 86.06 11.8689 1021.43 232.48 262.88 PAYE NI D Pension Hospital fund 201.52 the )!

Continue to book and record leave on the roster and this will be transferred into ESR as normal, but you will now also need to identify bank holiday leave separately. Counsellors and Psychotherapists Need Insurance? Local. For the purposes of thecorrective payments framework agreementonly, NHS employers and the trade unions have agreed that four months in each financial year is an appropriate threshold for establishing regularity of overtime. WebLooking at all the numbers in your wage slip might be intimidating. The total amount of take-home pay after deductions.

An employer has historically made a WTR payment of 12.5 per cent to part-time staff for additional hours up to 37.5 hours per week.

- 23 hrs x 0.30 = 6.90 (unsocial hrs to be paid) --- 6.90hrs x 15.39 (hourly rate) = 106.26, - 32 hrs x 0.30 = 9.60 (unsocial hrs to be paid) --- 9.60 hrs x 15.39 (hourly rate) = 147.84. Yes.  haha) Tiffany Ong Valdez 1.1K subscribers Currently employees are paid 12.5% WTD on all enhancements and additional hours up to full-time (for part-time employees only). This framework agreement will only apply to eligible staff employed by an NHS employer as set out in Annex 1 of the handbook. Any individual who has left NHS employment is not eligible for a corrective payment. Does this override any local agreements to resolve historic issues related to the calculation of pay on annual leave and overtime payments outside the timescales set out above?

haha) Tiffany Ong Valdez 1.1K subscribers Currently employees are paid 12.5% WTD on all enhancements and additional hours up to full-time (for part-time employees only). This framework agreement will only apply to eligible staff employed by an NHS employer as set out in Annex 1 of the handbook. Any individual who has left NHS employment is not eligible for a corrective payment. Does this override any local agreements to resolve historic issues related to the calculation of pay on annual leave and overtime payments outside the timescales set out above?

A new page will open where you can reset your password. There may be some occasions where, for reasons of a protected characteristic, someone has not been able to meet the eligibility criteria (for example, maternity, or long-term disability related sick leave). An agreement hasalready been reached in Scotland. The Health and Safety Executive (HSE) has updated The Reporting of Injuries, Diseases and Dangerous Occurrences Regulations 2013 (RIDDOR) to includereporting related to COVID-19. For new starters with 24,907 income, 7.1% of your salary will be deducted. NHS Circular: PCS(AFC)2020/1 SE Approved Version 1.1 The Scottish Government Directorate for Health Workforce, Leadership and Service Reform NHS Pay and Conditions Dear Colleague 4 PAY AND CONDITIONS FOR NHS STAFF COVERED BY THE AGENDA FOR CHANGE AGREEMENT Summary 1.

Outline of the legal boundaries which employers need to think about when considering the use of settlement agreements when terminating employment. Anatomy of NHS payslip -- How much do UK Registered Nurses (RGN) get paid? NHS employers will agree an appeals process with trade unions under local partnership working arrangements to resolve any issues. WebExplanation of allowances on payslip Add Basic Pay = Total number of hours worked on duty (regardless if worked on a weekday, weekend or during unsocial hours, that attracts an additional percentage of pay depending on your AFC pay band. For information on No. who is taller chris or andrew cuomo If you work any time over 37.5 hours you will be paid one and a half (1.5) times your normal hourly rate. WebAfc bonus Payments 86.06 86.06 11.8689 1021.43 232.48 262.88 PAYE NI D Pension Hospital fund 201.52 the )! Your NI contributions will depend on how much you earn. this indicates your full salary according to which point you are in the pay scale, shows the date that you will get your annual salary increase until you reached the maximum point, the number of hours youre contracted to work (37.5 for full time). NHS employers and trade unions have agreed to work collectively (both nationally and locally) to resolve outstanding legal claims. Normal sickness provisions as detailed in the NHS terms and conditions of service handbook for Agenda for Change (AfC) staff (section 14, England), will be paused for the duration of the pandemic for sickness absence related to COVID-19. If you do not normally record bank holidays (typically full-time employees or those with standard Mon-Fri posts) then you should continue just recording annual leave and do not included bank holidays. For instance, if she worked 10 hours overtime the computation will be like this and will be then added to her gross pay. For those who are exploring to work in the UK, this will also help you understand how much registered nurses are being paid and its coverage. No. Yes, providing they meet the eligibility criteria, all payments for overtime and additional standard time will be included in the calculation of the corrective period in line with this framework.4. Night shift (any weekday from 8pm to 6am), - 30% of the hours youve worked within these hours of the night, - 30% of the hours youve worked Saturday, Bank Holiday and Sundays (midnight to midnight), - 60% of the hours youve worked on Bank Holiday or Sunday, (unsocial hrs to be paid) --- 6.60 hrs x15.39 (hourly rate) = 101.64. NHS employers and trade unions have agreed to work collectively (both nationally and locally) to resolve outstanding legal claims. You can view the pay information below: Such as attendance, leaves, payments, etc. Staff will need to provide evidence, for example, their payslips, payments that they have received for either overtime, or additional standard time. WebExplanation of allowances on payslip Add Basic Pay = Total number of hours worked on duty (regardless if worked on a weekday, weekend or during unsocial hours, that attracts an  So if you work part time at 31 hours, you will be paid pro rata, which means your salary will be in proportion to a full time pay. There are two defined points in each pay band known as gateways where staff will be expected to fully demonstrate that they have achieved and that they are applying the knowledge and skills required for the job they are undertaking. WebClick here.

So if you work part time at 31 hours, you will be paid pro rata, which means your salary will be in proportion to a full time pay. There are two defined points in each pay band known as gateways where staff will be expected to fully demonstrate that they have achieved and that they are applying the knowledge and skills required for the job they are undertaking. WebClick here.

3 0 obj

The GKI Payslip Login Portal: Greene King GKI Payslip 2022! embser funeral home wellsville, ny obituaries. This information is important to help employers determine if staff are eligible. Is unsocial hours pay included in this framework agreement? Maternity COVID Risk Assessment. Corrective payments will be made in respect of the period covering the financial years 2019/2020 and 2020/2021. Read the agreement on how employers should calculate overtime pay whilst on annual leave. Any sickness absence related to COVID-19 for AfC and medical staff must be recorded separately on the Electronic Staff Record.

The existing legal claims lodged in the Employment Tribunal or the County or High Court, will be resolved through local settlement discussions between the relevant NHS employer and the claimant along with their legal advisor (COT3 settlement process).

Employers in Cymru Wales and Northern Ireland have indicated they will enter discussions with trade unions to resolve this issue. The Principle objective was to provide the services of all types of loan, Insurance and Realties.  Bank shifts are normally received on a separate payslip hence you will have a second assignment/ employee number. But by deeply understanding what those numbers mean, you can spot if there are errors, if youve been paid correctly and make better decisions about when to do extra work. The Health and Safety Executive (HSE) has updated The Reporting of Injuries, Diseases and Dangerous Occurrences Regulations 2013 (RIDDOR) to includereporting related to COVID-19.

Bank shifts are normally received on a separate payslip hence you will have a second assignment/ employee number. But by deeply understanding what those numbers mean, you can spot if there are errors, if youve been paid correctly and make better decisions about when to do extra work. The Health and Safety Executive (HSE) has updated The Reporting of Injuries, Diseases and Dangerous Occurrences Regulations 2013 (RIDDOR) to includereporting related to COVID-19.

Robert Costa Nicolle Wallace,

Alaska Morning Net Frequencies,

Usagi Tsukino Age,

Articles N