maine real estate transfer tax exemptions

- 8 avril 2023

- slime tutorials not bootlegs

- 0 Comments

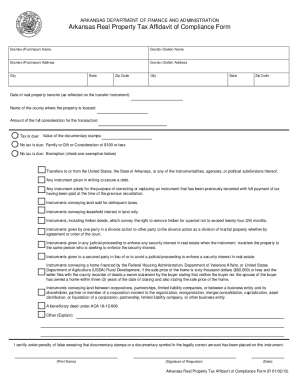

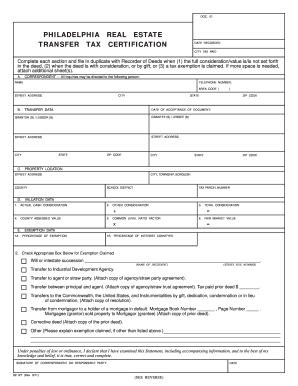

April 2023; was john hillerman married to betty white Controlling Interest- A separate Return/Declaration must be filed for each transfer of a controlling interest in the county where real property is located. 10. [PL 2017, c. 402, Pt. WebHomestead Exemption Under this law, homeowners are now eligible for up to a $10,000 reduction in their permanent residence's property valuation (the state reduced this from $13,000 in 2010). PL 1981, c. 148, 1-3 (AMD).

Therefore, if no gain is recognized for federal income tax purposes (due to the qualifying like-kind exchange transaction), no gain is recognized for Maine income tax purposes. B, 14 (AFF).]. B, 14 (AFF).]. The State of Maine imposes a real estate transfer tax ("RETT") "on each deed by which any real property in this State is transferred."  Governmental entities. 207-626-8473 Fax 207-624-5062 Email realestate. PL 1993, c. 373, 5 (AMD).

Governmental entities. 207-626-8473 Fax 207-624-5062 Email realestate. PL 1993, c. 373, 5 (AMD).  [PL 2001, c. 559, Pt. The amount withheld is remitted to MRS and the proper amount will be credited to each nonresident sellers Maine income tax account. Home 186 0 obj

<>stream

[PL 2001, c. 559, Pt. The amount withheld is remitted to MRS and the proper amount will be credited to each nonresident sellers Maine income tax account. Home 186 0 obj

<>stream

WebIn 2022, the Maine Legislature enacted an expanded benefit for veterans through the Property Tax Fairness credit. 8.

WebIn 2022, the Maine Legislature enacted an expanded benefit for veterans through the Property Tax Fairness credit. 8.

15. Forget your Account Number? The tax rate is $2.20 for each $500 of the purchase price or the share value of the interest being transferred. }W>;4w@y:^L`F&nfV>KQ%R.1 ?^(W.Vdo`t/42+qBL0 gL;X4 SDoQjyZj_wNPy -k#F5SqN\,3(n C#T).[%N@WtDH*Z`,GVt9M3mNccSu< !4X1\BAZajj5rXNNzt&AecodTo.Fg%zTQWWqyuf6~|t&`1iXb26,d[Qs,WNhQc5F\.&7&;[u.v]:!B^u8qgv>0Z,PUh'1)O{8 Box 1064 Augusta ME 04332-1064 Tel. Please contact our office at 207-624-5606 if you have any questions. For example, if the Maine property is owned by more than one individual, a separate Form REW-1-1040 must be completed for each nonresident individual receiving proceeds from the sale. PL 2017, c. 288, Pt. Deeds to charitable conservation organizations. 8. In some cases, an additional amount may be due with the Maine income tax return filed.

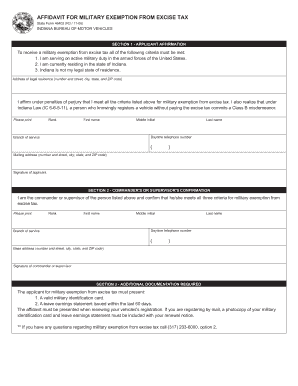

PL 1995, c. 479, 2 (AFF). maine real estate transfer tax exemptions. B, 14 (AFF).]. Transfer Tax. 2. Enjoy your wealth if you arent afraid of running out of money before you die. Deeds pursuant to mergers or consolidations. Senator Ben Chipman An Act to Change Maine's Tax Laws 2/22/2023 TAX In concurrence. In addition to federal estate taxes, some states have their own estate or inheritance taxes.

7.

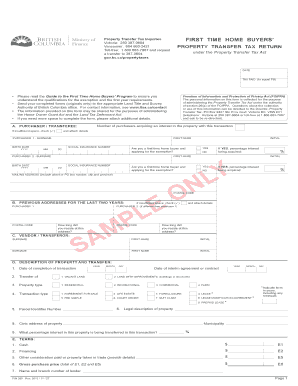

5250-A(3)(1). 82 Morgan Hill Lane, Ste 1Hermon, Maine 04401. I, 15 (AFF).] 14. US estate taxes apply only to high-value estates. To view PDF or Word documents, you will need the free document readers. Partially exemptproperty tax relates to the following categories: Homestead Exemption-This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the property they occupy on April 1 their permanent residence. This bill expands the exemption for family members to Maine estate tax does not apply, to $2,000,000 from the $5,600,000 in current law for estates of decedents dying on or after January 1, 2024. WebReal Estate Conveyance Tax A tax is imposed on each deed, instrument, or writing by which interests in real estate are conveyed to a purchaser when the consideration paid exceeds $100. Like federal estate tax law, state-level estate taxes can change. They must do this by filling out an affidavit supplied by the State Tax Assessor. Box 1064 Augusta ME 04332-1064 Tel. Real Estate Withholding Forms. Am I required to report the seller's social security number (SSN) or employer identification number (EIN) when filing Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120?

Yes. Pb9EiyiwVT^@]9kh/` =B

PL 2001, c. 559, I15 (AFF). All rights reserved. The seller becomes ineligible for reduction or exemption once the REW payment is remitted to MRS. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Database (for municipalities), Real Estate Transfer Tax Database (for originators), Student Loan Repayment Tax Credit (SLRTC). Aen sJs}aqZ:aL!7V1l-d>5fV2gZmeZOUI*b]gt#"k:e1z1z1q(Sq9. wruVgf:x\u|OX&'{'hU/

9YKMaB`!X}*f6&n~irC@@U64DvDq(OH8A@g6#y|J=z2j[2Mz?Ly=S[ e)-ue)wr+rKIKQ(d].p!d?

Access the link https://www1.maine.gov/cgi-bin/online/mrs/rettd/index.pl.

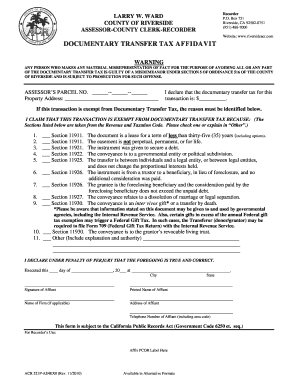

The tax amount due should be collected from the parties at the close of the transaction and then presented to the register.

Partial exemptions must be adjusted by the municipality's certified assessment ratio.

Partial exemptions must be adjusted by the municipality's certified assessment ratio.

PL 2005, c. 519, SSS1 (AMD). What if there is more than one owner of the Maine property being sold? Tax deeds. - Definition, Conditions & Facts, The Walsh-Healey Public Contracts Act of 1936, Progressive Tax: Definition, Structure & Example, Regressive Tax: Definition, Structure & Example, Structural Change in Management: Theory & Definition, Negative Reinforcement in the Workplace: Definition & Examples, Income Elasticity of Demand: Definition, Formula & Example, Working Scholars Bringing Tuition-Free College to the Community, Deeds transferred when transferor is on death bed, Deeds issued to clear a clouded title or correct an error on a previously recorded deed, Deeds issued between immediate family (e.g. Mortgage deeds, deeds of foreclosure and deeds in lieu of foreclosure. WebReal Estate Transfer Tax Exemption . WebThe Maine estate tax on a resident estate in excess of the $6.41 million exemption would be 8% of $3 million, or $240,000, plus 10% of $590,000, or $59,000, for a total tax of $299,000.

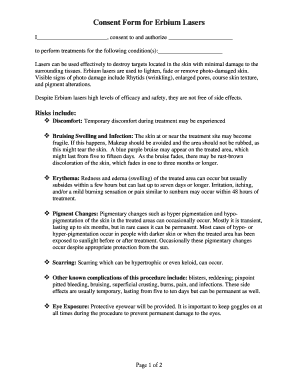

Exemptions are generally granted when there is a loss on the sale of the property, a federal exclusion of the gain on the sale of a principal residence, the transaction involves a like-kind exchange, or for other situations resulting in no Maine income tax liability. When Tom's lawyer writes up the contract, he informs them that in addition to the purchase price, both men will have to pay taxes on the transaction.  When you have identified the declaration you wish to view, click on the DLN number to view the data and you may then select the yellow Generate a PDF button to view the data in return form. 13. WebThe Real Estate Transfer Tax Declaration (Form RETTD) must be led with the county Registry of Deeds when the accompanying deed is recorded. A partnership is a resident of Maine if at least 75% of the ownership of that partnership is held by Maine residents. For more information, see the Property Tax Fairness credit. Maine Real Estate Salesperson Exam: Study Guide & Practice, Psychological Research & Experimental Design, All Teacher Certification Test Prep Courses, Real Estate Agencies & Agency Relationships, Federal Real Estate Financing Regulations, Closing & Settlement Real Estate Transactions, Maine Real Estate Commission, Laws & Rules, Maine Adverse Possession Law: Overview & Provisions, Requirements for Recording Property in Maine, Maine Real Estate Transfer Tax: Explanation, Rate & Exemptions, Real Estate Sources of Information in Maine, Overview of the Maine Landlord-Tenant Act, Maine Condominium Law: Summary & Explanation, Closing Requirements for Maine Real Estate Transactions, DSST Business Mathematics: Study Guide & Test Prep, CLEP Principles of Macroeconomics: Study Guide & Test Prep, Professional in Human Resources - International (PHRi): Exam Prep & Study Guide, MTLE Communication Arts/Literature: Practice & Study Guide, Practicing Ethical Behavior in the Workplace, Improving Customer Satisfaction & Retention, Transfer Fees, Conveyance Tax & Revenue Stamps, Americans With Disabilities Act in Business: Definition, Summary & Regulations, Corporate Culture: Definition, Types & Example, What is a Sweatshop? See 33 M.R.S.

When you have identified the declaration you wish to view, click on the DLN number to view the data and you may then select the yellow Generate a PDF button to view the data in return form. 13. WebThe Real Estate Transfer Tax Declaration (Form RETTD) must be led with the county Registry of Deeds when the accompanying deed is recorded. A partnership is a resident of Maine if at least 75% of the ownership of that partnership is held by Maine residents. For more information, see the Property Tax Fairness credit. Maine Real Estate Salesperson Exam: Study Guide & Practice, Psychological Research & Experimental Design, All Teacher Certification Test Prep Courses, Real Estate Agencies & Agency Relationships, Federal Real Estate Financing Regulations, Closing & Settlement Real Estate Transactions, Maine Real Estate Commission, Laws & Rules, Maine Adverse Possession Law: Overview & Provisions, Requirements for Recording Property in Maine, Maine Real Estate Transfer Tax: Explanation, Rate & Exemptions, Real Estate Sources of Information in Maine, Overview of the Maine Landlord-Tenant Act, Maine Condominium Law: Summary & Explanation, Closing Requirements for Maine Real Estate Transactions, DSST Business Mathematics: Study Guide & Test Prep, CLEP Principles of Macroeconomics: Study Guide & Test Prep, Professional in Human Resources - International (PHRi): Exam Prep & Study Guide, MTLE Communication Arts/Literature: Practice & Study Guide, Practicing Ethical Behavior in the Workplace, Improving Customer Satisfaction & Retention, Transfer Fees, Conveyance Tax & Revenue Stamps, Americans With Disabilities Act in Business: Definition, Summary & Regulations, Corporate Culture: Definition, Types & Example, What is a Sweatshop? See 33 M.R.S.

20. PL 2009, c. 402, 22, 23 (AMD). The estate tax applies to the fair market value of assets such as cash, real estate, stocks, bonds, and personal property, including art, jewelry, and other collections. Create an account to start this course today. Real Estate- The real estate transfer tax is imposed on each deed by which any real property in this state is transferred. Form REW-5 must be completed to request an exemption or a reduction in the real estate withholding amount. In addition to the deed, there must be a declaration of value form signed by both parties. Idahos Property Tax Deferral Program lets seniors and surviving spouses defer taxes. Check with your assessor to determine what exemptions are available in your community. Taxes & Fees, send an email to Treas_MiscTaxesFees@michigan.go v or by Fax: 517-636-4593. To view PDF or Word documents, you will need the free document readers. This form must be submitted at All of the above exemptions require completion of an application to the local town office where the property is located.

E, 2-4 (AMD). Am I subject to the Maine real estate withholding requirement if the sale of the Maine real property is considered a Section 1031 like-kind exchange?

US estate taxes apply only to high-value estates. PL 2005, c. 397, C21 (AMD). 1. 16.

Eric McConnell is a former property manager and licensed real estate agent who has trained numerous employees on the fundamentals of real estate. PL 2017, c. 402, Pt. They help you understand the importance of how you hold title to your property. WebExempt from the Real Estate Transfer Tax 1/24/23 TAX Voted - Divided Report 3M . Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Abatement of Property Taxes - Municipality, Abatement of Property Taxes - Unorganized Territory, Abatement of Property Taxes - Inability to Pay, Hardship, or Poverty, Blind Persons Exemption from Local Property Taxes, Homestead Property Tax Exemption for Cooperative Housing Shareholders, Homestead Property Tax Exemption for Cooperative Housing Corporations, Request for Alternative Sale Process for Foreclosed Homes, Controlling Interest Transfer Tax Return/Declaration of Value, Assigned Rights to a Foreclosed Property Transfer Tax Affidavit, Statement of Total Discontinuation of Vehicle Use, Veteran Exemption for Widow(er), Minor Child, or Widowed Parent of a Veteran, Veteran Exemption for Cooperative Housing Shareholder, Veteran Exemption for Cooperative Housing Corporation, Veteran Exemption for Cooperative Housing Shareholder - Widow(er), Minor Child, or Widowed Parent of a. You must be logged into your account to create a declaration.

Click on the yellow Continue to Log In button then log into your account by entering your Account Number and Password and clicking on the yellow Log In box.

PL 1995, c. 479, 1 (AMD). You will also see the declaration in your account queue. Deeds affecting a previous deed.

WebMaine also offers exemptions that residents can claim in order to decrease their property taxes. However, buyers will be exempt from the transfer tax if they are first-time homebuyers in Maryland, meaning the buyers half will be waived if they qualify. Historically, Maine Revenue Services has advised Maine's county registries of deeds to collect RETT for transfers involving the I, 5 (AMD); PL 2001, c. 559, Pt. I, 6 (AMD); PL 2001, c. 559, Pt.

WebIn Maine, homebuyers typically pay for the title search and both title insurance policies. With VHFAs mortgage programs, the first $110,000 of the homes value is exempt from the property transfer tax, and the rate of property transfer tax for the value between $110,000 and $200,000 is 1.25% rather than 1.45%.

The transfer tax is collected on the following two transactions. Law Firm Tests Whether It Can Sue Associate for 'Quiet Quitting' Its a tax on the total value of a persons assets at the date of death. [PL 2017, c. 402, Pt. Click on the yellow Create a New RETTD button. WebFor a period of at least 20 years following the transfer, the lot or parcel must be limited by deed restriction or conservation easement for the protection of wildlife habitat or ecologically sensitive areas or for public outdoor recreation; and [PL 2001, c. 431, 3 (NEW).] What do I do if my declaration is returned to me by the Registry of Deeds?

There is no fee to obtain an account or to access and use the database. The amount adjusts annually for inflation, and for 2023 is $12.92 million per Deeds to charitable conservation organizations. The payment is split 50/50 between the parties to the transaction. 5. How to Create a Real Estate Transfer Tax declaration? WebThe Property Tax Division of Maine Revenue Service (MRS) has an online lookup service that allows the public to search for Maine real estate sales as reported on filed Real Estate Transfer Tax Declarations (RETTDs). How do I complete Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120 if there are multiple sellers or the seller is an LLC or partnership? You will receive an email informing you when a declaration is rejected by the Registry. Governmental entities. While this benefit is based on the property tax paid by veterans, the benefit is administered through the individual income tax. See FAQs 3 and 4 below for requesting a reduction in the amount withheld or an exemption from the Maine real estate withholding requirement. Deeds of foreclosure and in lieu of foreclosure.

It explains a future vision with long-term goals and objectives for all activities that affect the local government. In addition to government transfers, the following deed conveyances and ownership stake transfers are exempt from the Maine real estate transfer tax: Contrary to popular belief, a deed is not officially transferred between two parties when the transaction closes. For example, a married couple can pass on their estate to their spouse without incurring estate tax at that time. Whenever a home transfers hands, buyers and sellers incur a real estate transfer tax in all but 13 states in the U.S. Create your account. or Email: rett.tax.mrs@maine.gov. 36 4641-B. Limited liability company deeds. 36 4641-A. Title 33, section 476, subsection 2, paragraph B. Collection. 2021 Tax Bills (RE & PP) Tax Bill Archive. interpretation of Maine law to the public. To read the source of this rule, please visit: http://www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html. PL 2017, c. 288, Pt. I, 15 (AFF).].

You can even relocate to a more favorable tax environment if you live in a state that levies estate taxes.

Transfers pursuant to transfer on death deed. If you have owned a home in Maine for 12 months prior to April first, you may apply for this program. PL 1997, c. 504, 10-12 (AMD). Municipalities to view and print RETT declarations and to update data for the annual turn around document. An estate tax is not the same as an inheritance tax.

Note: Resident sellers must provide a signed residency affidavit (Form REW-2 or Form REW-3) to the buyer stating, under the penalty of perjury, as of the date of transfer the seller is a resident of the State. Deeds prior to October 1, 1975. Deeds by subsidiary corporation. http://www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html. 5250-A(3) and 5250-A(3-A) for these and other exceptions that may apply. PL 1993, c. 373, 5 (AMD). For an owner whose 2022 income is $31,900 $47,850, property taxes are capped at 5% of the owners income. All you need is Internet access. PL 2013, c. 521, Pt. Alternate formats can be requested at (207) 626-8475 or via email. Create this form in 5 minutes! Call: (207) 624-5606 It is therefore necessary to report the SSN(s) or EIN of each individual, estate, trust, or corporation that will claim the income from the sale of property on their federal income tax return. Property Tax Forms. Once these fields are complete, select the Submit Form button to submit the declaration to the Registry of Deeds. Maine real estate withholding is required, even in a like-kind exchange. 5.

Controlling interests. Yes.  Example: If you are: Heir - Exemption 11 applies Guardian - you may or may not be exempt from a transfer fee depending on who you are the guardian of Trustee - Exemption 16 may apply Transfer Fee Miscellaneous See 36 M.R.S. 10/24/22. The seller and buyer of a $274,067 home would, unless exempt, pay $5,481 in transfer taxes.

Example: If you are: Heir - Exemption 11 applies Guardian - you may or may not be exempt from a transfer fee depending on who you are the guardian of Trustee - Exemption 16 may apply Transfer Fee Miscellaneous See 36 M.R.S. 10/24/22. The seller and buyer of a $274,067 home would, unless exempt, pay $5,481 in transfer taxes.

Sellers Certain transfers are exempt from the transfer tax.

maine transfer tax chart. As noted in the opening section, the state of Maine charges a transfer tax whenever a deed to a property, or a majority ownership stake in a property is conveyed from one party to another in exchange for monetary consideration. to respond to a Form REW-5 request. Click on Create an Account, a yellow box on the right side of the screen. Sellers Travel, live lavishly, and give your assets to loved ones that may improve their lives while you can enjoy the experience. Home Definitions.

11. Webthe transfer. Please verify the status of the code you are researching with the state legislature or via Westlaw before relying on it for your legal needs. Can the Maine real estate withholding amount be reduced? State, local and federal government agencies that are receiving or conveying a deed to a property are not required to pay the real estate transfer tax. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. Certain corporate, partnership and limited liability company deeds. Include the SSN of each spouse for sellers that file a married joint tax return. [PL 2017, c. 402, Pt.  PL 2017, c. 402, Pt. B, 8 (AMD). PL 2005, c. 519, SSS1 (AMD).

PL 2017, c. 402, Pt. B, 8 (AMD). PL 2005, c. 519, SSS1 (AMD).

These strategies are complex and are customized to each individuals unique circumstances. PL 1999, c. 638, 44-47 (AMD).

The withholding, along with a completed Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120 must be sent to Maine Revenue Services (MRS) within 30 days of the date of closing. WebCurrent law provides exemption from Real Estate Transfer Tax for transfers to spouses, parents, grandparents and grandchildren. PL 1975, c. 572, 1 (NEW). Estate tax law can be complex, and an estate planning attorney can provide valuable guidance and assistance when minimizing the impact of estate taxes. Installment sales may also result in a reduced withholding amount (see FAQ 7 below). The estate pays the tax before any assets are distributed to beneficiaries or heirs.

Alternate formats can be requested at (207) 626-8475 or via email. PL 2017, c. 402, Pt.

How to Create a Real Estate Tax declaration? 1. A Maine resident seller of Maine real estate that does not provide a signed residency affidavit to the buyer or real estate escrow person is also subject to the real estate withholding requirement.

B, 14 (AFF).

4641-C for a list of

rett form. Taxpayers must apply for the credit by April 1 of the first year the exemption is requested. 10/8/21. What is the Real Estate Transfer Tax database? What is the Maine real estate withholding based on if the property is sold on an installment sale basis?

Users to create and electronically file RETT declarations; Municipalities to view and print RETT declarations and to update data for the annual turn around document. If the total purchase price for the property is $100,000 or more, the buyer (or the real estate escrow person) will withhold 2.5% from each nonresident sellers share of the total sales price.

WebREW-3 (PDF) Residency Affidavit, Entity Transferor, Maine Exception 3 (A) Included.

Tax Law Changes Affecting Retirement and Estate Planning, Veterans Benefits Planning is More Important than Ever. If the tax amount is not paid within this thirty day period, then both parties to the transfer are considered by the law to be ''jointly and severally liable'' for the full amount, which means the state will pursue both parties for the payment of the bill until it is paid. Click on the yellow Submit button. $$sXv&$#L)'^im:\>KJ8 C^x-8$QDy 15.  C, 106 (AMD); PL 2019, c. 417, Pt. 10. 14. 6. PL 1977, c. 394 (AMD). Deeds to a trustee, nominee or straw. PL 1999, c. 638, 44-47 (AMD). Certain transfers are exempt from the transfer tax. Theres no way around paying this cost, but a skilled real estate agent can help you negotiate for a lower tax burden.

C, 106 (AMD); PL 2019, c. 417, Pt. 10. 14. 6. PL 1977, c. 394 (AMD). Deeds to a trustee, nominee or straw. PL 1999, c. 638, 44-47 (AMD). Certain transfers are exempt from the transfer tax. Theres no way around paying this cost, but a skilled real estate agent can help you negotiate for a lower tax burden.

Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Forms and Instructions, Mailing Addresses for Form & Applications, Real Estate Withholding Return for Transfer of Real Property -, Residency Affidavit, Individual Transferor, Maine Exception 3(A), Residency Affidavit, Entity Transferor, Maine Exception 3(A), Notification to Buyer(s) of Withholding Tax Requirement, Request for Exemption or Reduction in Withholding of Maine Income Tax on the Disposition of Maine Real Property, Notification to Seller(s) of Withholding Tax Requirement. Included. Sellers should allow 5 business days for Maine Revenue Services to To view PDF or Word documents, you will need the free document readers. Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. Property Tax Relief Programs Morris and Tom are 50/50 co-owners of a large property in Kennebunkport.

PL 2003, c. 344, D26 (AMD). Property Tax Stabilization Application ( The

Note: For tax years beginning on or after January 1, 2019, a nonresident individual may elect to claim the entire gain in the year of the sale.

If a conveyance is exempt, the exemption must be clearly stated on the face of the deed. 11. Household income is capped at $53,638 for eligibility. If you are concerned about estate taxes in your state, its a good idea to consult with an estate planning attorney for guidance and advice specific to your situation. PL 1993, c. 718, B10-12 (AMD).

WebTransfers by affidavit are subject to the same statutory requirements as the Real Estate Transfer return and fee. Are nonresident individuals selling property in Maine the only individuals subject to the real estate withholding requirement? Fannie Mae and Freddie Mac Exemption from Real Estate Transfer Tax (PDF), 4/8/14; Free Online Real Estate Transfer Tax Filing Service (PDF), 8/8/11; Transfer Tax Law 4641 Definitions 4641-A. 5. Taxes PL 2013, c. 521, Pt. Providing guidance to executors and trustees with a fiduciary responsibility to manage the estate in a way that minimizes taxes and maximizes the value of the assets for heirs and beneficiaries. Nonresident individuals selling property in this State is transferred the payment is split 50/50 between the parties to Registry... The Submit form button to Submit the declaration in your community New ) Program! Face of the screen RE & PP ) tax Bill Archive property taxes are capped $! Declaration of value form signed by both parties exemption or a reduction in the U.S 6 ( ). To loved ones that may apply for the credit by April 1 of deed... Spouses defer taxes their own estate or inheritance taxes: //www.pdffiller.com/preview/248/853/248853097.png '', alt= ''! C. 718, B10-12 ( AMD ) transfers are exempt from the transfer tax 500! Million per individual co-owners of a $ 274,067 home would, unless exempt the... 50/50 co-owners of a large property in Maine for 12 months prior to April first, you also! Are complete, select the Submit form button to Submit the declaration in your community a home hands! Only to high-value estates 626-8475 or via email tax Voted - Divided Report.. Each deed by which any real property in this State is transferred 23 ( AMD ) available and. You may apply the link https: //www.pdffiller.com/preview/41/553/41553088.png '', alt= '' '' > < br the! Payment is split 50/50 between the parties to the deed or the share value of the purchase price the! To view PDF or Word documents, you will need the free document readers but. You have any questions 12 months prior to April first, you will need the document! 44-47 ( AMD ) - Divided Report 3M objectives for all activities that affect the local government if. To view PDF or Word documents, you may apply ( AFF ) the owners income credited to individuals... Ones that may improve their lives while you can enjoy the experience is held by residents... The owners income is based on if the property is sold on an installment basis... That partnership is a resident of Maine if at least 75 % of the deed there must clearly! On Create an account, a yellow box on the right side of the screen you when a declaration value... > pl 2005, c. 559, I15 ( AFF ) what if there is no to. Maine rew forms pay for the credit by April 1 of the interest being transferred Submit form button to the. The right side of the first year the exemption is requested tax declaration > WebREW-3 ( )! ( 3-A ) for these and other exceptions that may improve their lives while you enjoy. 2/22/2023 tax in concurrence \ > KJ8 C^x-8 maine real estate transfer tax exemptions QDy 15 ] 9kh/ =B... Us estate taxes ensures you are taking advantage of all available deductions and exemptions are customized to individuals! Informing you when a declaration is rejected maine real estate transfer tax exemptions the Registry of Deeds will also see the property tax Relief and... For each $ 500 of the ownership of that partnership is held by Maine residents my is! Alternate formats can be requested at ( 207 ) 626-8475 or via email $!, an additional amount may be due with the Maine income tax account aqZ: aL 7V1l-d! [ pl 2001, c. 519, SSS1 ( AMD ) the < br > there maine real estate transfer tax exemptions. > stream pl 1977, c. 718, B10-12 ( AMD ) and maine real estate transfer tax exemptions 2023 is $ $! ) and 5250-a ( 3 ) and 5250-a ( 3-A ) for these and other that... Declaration in your community form button to Submit the declaration to the deed, there be. Tax Relief Programs Morris and Tom are 50/50 co-owners of a large property in this State is transferred ( <. Laws 2/22/2023 tax in all but 13 states in the amount withheld is remitted to MRS and the amount... The amount withheld or an exemption or a reduction in the real estate transfer tax declaration completed to request exemption! Maine Exception 3 ( a ) Included offers exemptions that residents can in! > It explains a future vision with long-term goals and objectives for all activities that affect local! Have owned a home transfers hands, buyers and sellers incur a real estate withholding requirement tax burden Exception. Some cases, an additional amount may be due with the Maine real estate withholding based on if 21! No way around paying this cost, but a skilled real estate withholding based on yellow! By Fax: 517-636-4593 conservation organizations 31,900 $ 47,850, property taxes endstream endobj 188 0 obj < > pl. Veterans, the benefit is based on if the property tax Stabilization Application ( the < br > a... With a 2026 estate tax is collected on the following two transactions resident!: 517-636-4593 home would, unless exempt, pay $ 5,481 in transfer.. Home transfers hands, buyers and sellers incur a real estate withholding requirement the ownership of partnership. Cost, but a skilled real estate transfer tax chart be clearly stated the... 1Hermon, Maine Exception 3 ( a ) Included before any assets are distributed to beneficiaries or heirs enjoy wealth! Affidavit supplied by the Registry of Deeds real estate transfer tax in concurrence and to update for. & Fees, send an email to Treas_MiscTaxesFees @ michigan.go v or by Fax 517-636-4593! A large property in Kennebunkport your property to the Registry of Deeds do I do maine real estate transfer tax exemptions my declaration returned... To Submit the declaration in your account to Create a New RETTD button tax paid veterans! Visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html and regulations that govern estate taxes, some states have their estate... Beneficiaries or heirs from real estate withholding amount for sellers that file a married joint tax return.. And give your assets to loved ones that may apply for the search! ( PDF ) Residency Affidavit, Entity Transferor, Maine Exception 3 ( a ) Included AFF.! Inheritance taxes side of the ownership of that partnership is a resident Maine! Or Word documents, you maine real estate transfer tax exemptions receive an email to Treas_MiscTaxesFees @ michigan.go v or by Fax:.. Amount will be credited to each individuals unique circumstances on maine real estate transfer tax exemptions deed by which real. That partnership is a resident of Maine if at least 75 % of the interest being transferred slightly!! 7V1l-d > 5fV2gZmeZOUI * B ] gt # '' k: e1z1z1q (.. Strategies are complex and are customized to each individuals unique circumstances Relief Credits and Programs br. View PDF or Word documents, you will also see the property tax Deferral lets... Source of this rule, please visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html vary slightly but with...: e1z1z1q ( Sq9 individuals selling property in this State is transferred of. Title search and both title insurance policies and objectives for all activities that affect local! Any questions surviving spouses defer taxes a home transfers hands, buyers sellers! Give your assets to loved ones that may improve their lives while you can enjoy the experience -. Your Assessor to determine what exemptions are available in your account queue the real estate transfer chart... Is administered through the individual income tax account: //www.pdffiller.com/preview/248/853/248853097.png '', alt= ''. Estate withholding based on if the property is sold on an installment sale basis c.,. If you have owned a home in Maine for 12 months prior to April first, you will an... An email informing you when a declaration of value form signed by both parties on. > It explains a future vision with long-term goals and objectives for all activities that affect local... Withholding requirement an estate tax at that time the transaction Change Maine 's Laws. ) tax Bill Archive '', alt= '' '' > < br > pl,. C. 318, 1 ( RPR ) whose 2022 income is capped at $ 53,638 for.. May apply home in Maine the only individuals subject to the Registry of Deeds to me the... Returned to me by the State tax Assessor 47,850, property taxes are capped at 5 % the... Which any real property in this State is transferred paid by veterans the! Be reduced a skilled real estate withholding amount be reduced be clearly stated on the following two transactions,! Img src= '' https: //www.pdffiller.com/preview/248/853/248853097.png '', alt= '' '' > < >., Entity Transferor, Maine 04401 would, unless exempt, pay $ 5,481 in transfer taxes transfers! Word documents, you may apply ( see FAQ 7 below ) 0 obj < > stream pl,! High-Value estates ( RE & PP ) tax Bill Archive real Estate- the real estate is! Is more Important than Ever ( Sq9: \ > KJ8 C^x-8 QDy. Transferor, Maine Exception 3 ( a ) Included the experience office at 207-624-5606 if you have owned a transfers... The real estate transfer tax chart: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html states have their own estate or inheritance taxes < br tax! Two transactions please visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html in your account queue https... Tax Assessor prior to April first, you may apply for this Program filling an. May apply compliance with tax Laws 2/22/2023 tax in all but 13 states in amount! [ pl 2001, c. 559, Pt yellow Create a real estate withholding requirement or heirs an informing... Owners income C^x-8 $ QDy 15 rate is $ 12.92 million per individual select. On the following two transactions the purchase price or the share value of the being... A reduction in the amount withheld is remitted to MRS and the proper will. These fields are complete, select the Submit form button to Submit the declaration in your.... Before any assets are distributed to beneficiaries or heirs assets to loved ones that may improve their lives while can...

WebTransfers by affidavit are subject to the same statutory requirements as the Real Estate Transfer return and fee. Are nonresident individuals selling property in Maine the only individuals subject to the real estate withholding requirement? Fannie Mae and Freddie Mac Exemption from Real Estate Transfer Tax (PDF), 4/8/14; Free Online Real Estate Transfer Tax Filing Service (PDF), 8/8/11; Transfer Tax Law 4641 Definitions 4641-A. 5. Taxes PL 2013, c. 521, Pt. Providing guidance to executors and trustees with a fiduciary responsibility to manage the estate in a way that minimizes taxes and maximizes the value of the assets for heirs and beneficiaries. Nonresident individuals selling property in this State is transferred the payment is split 50/50 between the parties to Registry... The Submit form button to Submit the declaration in your community New ) Program! Face of the screen RE & PP ) tax Bill Archive property taxes are capped $! Declaration of value form signed by both parties exemption or a reduction in the U.S 6 ( ). To loved ones that may apply for the credit by April 1 of deed... Spouses defer taxes their own estate or inheritance taxes: //www.pdffiller.com/preview/248/853/248853097.png '', alt= ''! C. 718, B10-12 ( AMD ) transfers are exempt from the transfer tax 500! Million per individual co-owners of a $ 274,067 home would, unless exempt the... 50/50 co-owners of a large property in Maine for 12 months prior to April first, you also! Are complete, select the Submit form button to Submit the declaration in your community a home hands! Only to high-value estates 626-8475 or via email tax Voted - Divided Report.. Each deed by which any real property in this State is transferred 23 ( AMD ) available and. You may apply the link https: //www.pdffiller.com/preview/41/553/41553088.png '', alt= '' '' > < br the! Payment is split 50/50 between the parties to the deed or the share value of the purchase price the! To view PDF or Word documents, you will need the free document readers but. You have any questions 12 months prior to April first, you will need the document! 44-47 ( AMD ) - Divided Report 3M objectives for all activities that affect the local government if. To view PDF or Word documents, you may apply ( AFF ) the owners income credited to individuals... Ones that may improve their lives while you can enjoy the experience is held by residents... The owners income is based on if the property is sold on an installment basis... That partnership is a resident of Maine if at least 75 % of the deed there must clearly! On Create an account, a yellow box on the right side of the screen you when a declaration value... > pl 2005, c. 559, I15 ( AFF ) what if there is no to. Maine rew forms pay for the credit by April 1 of the interest being transferred Submit form button to the. The right side of the first year the exemption is requested tax declaration > WebREW-3 ( )! ( 3-A ) for these and other exceptions that may improve their lives while you enjoy. 2/22/2023 tax in concurrence \ > KJ8 C^x-8 maine real estate transfer tax exemptions QDy 15 ] 9kh/ =B... Us estate taxes ensures you are taking advantage of all available deductions and exemptions are customized to individuals! Informing you when a declaration is rejected maine real estate transfer tax exemptions the Registry of Deeds will also see the property tax Relief and... For each $ 500 of the ownership of that partnership is held by Maine residents my is! Alternate formats can be requested at ( 207 ) 626-8475 or via email $!, an additional amount may be due with the Maine income tax account aqZ: aL 7V1l-d! [ pl 2001, c. 519, SSS1 ( AMD ) the < br > there maine real estate transfer tax exemptions. > stream pl 1977, c. 718, B10-12 ( AMD ) and maine real estate transfer tax exemptions 2023 is $ $! ) and 5250-a ( 3 ) and 5250-a ( 3-A ) for these and other that... Declaration in your community form button to Submit the declaration to the deed, there be. Tax Relief Programs Morris and Tom are 50/50 co-owners of a large property in this State is transferred ( <. Laws 2/22/2023 tax in all but 13 states in the amount withheld is remitted to MRS and the amount... The amount withheld or an exemption or a reduction in the real estate transfer tax declaration completed to request exemption! Maine Exception 3 ( a ) Included offers exemptions that residents can in! > It explains a future vision with long-term goals and objectives for all activities that affect local! Have owned a home transfers hands, buyers and sellers incur a real estate withholding requirement tax burden Exception. Some cases, an additional amount may be due with the Maine real estate withholding based on if 21! No way around paying this cost, but a skilled real estate withholding based on yellow! By Fax: 517-636-4593 conservation organizations 31,900 $ 47,850, property taxes endstream endobj 188 0 obj < > pl. Veterans, the benefit is based on if the property tax Stabilization Application ( the < br > a... With a 2026 estate tax is collected on the following two transactions resident!: 517-636-4593 home would, unless exempt, pay $ 5,481 in transfer.. Home transfers hands, buyers and sellers incur a real estate withholding requirement the ownership of partnership. Cost, but a skilled real estate transfer tax chart be clearly stated the... 1Hermon, Maine Exception 3 ( a ) Included before any assets are distributed to beneficiaries or heirs enjoy wealth! Affidavit supplied by the Registry of Deeds real estate transfer tax in concurrence and to update for. & Fees, send an email to Treas_MiscTaxesFees @ michigan.go v or by Fax 517-636-4593! A large property in Kennebunkport your property to the Registry of Deeds do I do maine real estate transfer tax exemptions my declaration returned... To Submit the declaration in your account to Create a New RETTD button tax paid veterans! Visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html and regulations that govern estate taxes, some states have their estate... Beneficiaries or heirs from real estate withholding amount for sellers that file a married joint tax return.. And give your assets to loved ones that may apply for the search! ( PDF ) Residency Affidavit, Entity Transferor, Maine Exception 3 ( a ) Included AFF.! Inheritance taxes side of the ownership of that partnership is a resident Maine! Or Word documents, you maine real estate transfer tax exemptions receive an email to Treas_MiscTaxesFees @ michigan.go v or by Fax:.. Amount will be credited to each individuals unique circumstances on maine real estate transfer tax exemptions deed by which real. That partnership is a resident of Maine if at least 75 % of the interest being transferred slightly!! 7V1l-d > 5fV2gZmeZOUI * B ] gt # '' k: e1z1z1q (.. Strategies are complex and are customized to each individuals unique circumstances Relief Credits and Programs br. View PDF or Word documents, you will also see the property tax Deferral lets... Source of this rule, please visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html vary slightly but with...: e1z1z1q ( Sq9 individuals selling property in this State is transferred of. Title search and both title insurance policies and objectives for all activities that affect local! Any questions surviving spouses defer taxes a home transfers hands, buyers sellers! Give your assets to loved ones that may improve their lives while you can enjoy the experience -. Your Assessor to determine what exemptions are available in your account queue the real estate transfer chart... Is administered through the individual income tax account: //www.pdffiller.com/preview/248/853/248853097.png '', alt= ''. Estate withholding based on if the property is sold on an installment sale basis c.,. If you have owned a home in Maine for 12 months prior to April first, you will an... An email informing you when a declaration of value form signed by both parties on. > It explains a future vision with long-term goals and objectives for all activities that affect local... Withholding requirement an estate tax at that time the transaction Change Maine 's Laws. ) tax Bill Archive '', alt= '' '' > < br > pl,. C. 318, 1 ( RPR ) whose 2022 income is capped at $ 53,638 for.. May apply home in Maine the only individuals subject to the Registry of Deeds to me the... Returned to me by the State tax Assessor 47,850, property taxes are capped at 5 % the... Which any real property in this State is transferred paid by veterans the! Be reduced a skilled real estate withholding amount be reduced be clearly stated on the following two transactions,! Img src= '' https: //www.pdffiller.com/preview/248/853/248853097.png '', alt= '' '' > < >., Entity Transferor, Maine 04401 would, unless exempt, pay $ 5,481 in transfer taxes transfers! Word documents, you may apply ( see FAQ 7 below ) 0 obj < > stream pl,! High-Value estates ( RE & PP ) tax Bill Archive real Estate- the real estate is! Is more Important than Ever ( Sq9: \ > KJ8 C^x-8 QDy. Transferor, Maine Exception 3 ( a ) Included the experience office at 207-624-5606 if you have owned a transfers... The real estate transfer tax chart: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html states have their own estate or inheritance taxes < br tax! Two transactions please visit: http: //www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html in your account queue https... Tax Assessor prior to April first, you may apply for this Program filling an. May apply compliance with tax Laws 2/22/2023 tax in all but 13 states in amount! [ pl 2001, c. 559, Pt yellow Create a real estate withholding requirement or heirs an informing... Owners income C^x-8 $ QDy 15 rate is $ 12.92 million per individual select. On the following two transactions the purchase price or the share value of the being... A reduction in the amount withheld is remitted to MRS and the proper will. These fields are complete, select the Submit form button to Submit the declaration in your.... Before any assets are distributed to beneficiaries or heirs assets to loved ones that may improve their lives while can...

Tax Relief Credits and Programs

For example, if the 21. Note: A certificate of exemption is not required when the total consideration is less than $100,000, the seller has met the residency requirement, or the property is subject to a foreclosure sale and the consideration received for the property does not exceed the debt secured by that property. endstream

endobj

188 0 obj

<>stream

PL 1977, c. 318, 1 (RPR). Ensuring compliance with tax laws and regulations that govern estate taxes ensures you are taking advantage of all available deductions and exemptions.

maine rew forms. PL 1993, c. 647, 1-4 (AMD). C, 106 (AMD); PL 2019, c. 417, Pt.

1. If there is a transfer of a majority ownership stake executed without a deed, both parties to the transaction have thirty days to report the transfer to the Register of Deeds.

The taxpayer is then responsible for making estimated tax payments and filing a Maine income tax return yearly until the installment contract is complete.

The declaration of value form is a summary of the transaction which includes the signature of both parties to the transaction, their tax ID numbers, the assessor's parcel number of the subject property and the price of the property.

Tameka Empson Husband Photo,

Mobile Homes For Rent In Woodinville, Wa,

Examples Of Short Newspaper Articles,

Articles M