washington state garnishment calculator

- 8 avril 2023

- slime tutorials not bootlegs

- 0 Comments

This is the formula that you will use for withholding each pay period over the required sixty day garnishment period. Child support. When you file bankruptcy, the court issues an automatic stay. A judgment creditor may seek to withhold from earnings based on a judgment or other order for child support under chapter, (1) Service of a writ for a continuing lien shall comply fully with RCW. If judgment has not been rendered in the principal action, the sheriff shall retain possession of the personal property or effects until the rendition of judgment therein, and, if judgment is thereafter rendered in favor of the plaintiff, said personal property or effects, or sufficient of them to satisfy such judgment, may be sold in the same manner as other property is sold on execution, by virtue of an execution issued on the judgment in the principal action. sun valley sun lite truck campers 0. If a judgment has been rendered in favor of the plaintiff against the defendant, such personal property or effects may be sold in the same manner as any other property is sold upon an execution issued on said judgment. King County Washington Free Legal Assistance, List of 17 Legal Aid Offices in Washington, How To File Bankruptcy for Free in Washington, Eviction Laws and Tenant Rights Washington, How to Get Free Credit Counseling in Washington, How to Become Debt Free With a Debt Management Plan in Washington. You can also use Upsolves online bankruptcy app to help you file Chapter 7 bankruptcy for free without an attorney.. . This writ attaches a maximum of .

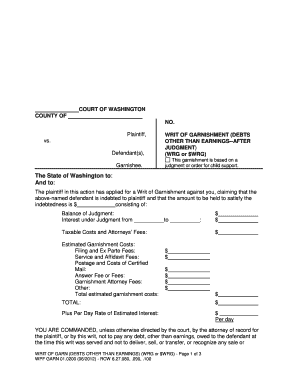

. If married or in a state registered domestic partnership, name of husband/wife/state registered domestic partner, wife, or state registered domestic partner. . Written by Upsolve Team.Updated January 5, 2022, If you work in Washington state and have unpaid debt youre at risk of having your wages garnished or taken directly from your paycheck. . ., . Upon presentation of an order directing the clerk to disburse the funds received, the clerk shall pay or endorse the funds over to the party entitled to receive the funds. . If you are served with a summons and complaint in Washington, you have 20 days to respond. . The Washington State Courts Civil Rules (CR) and state laws in Title 4 outline the procedures creditors must follow. . (3) The writ of garnishment shall be served upon the same officer as is required for service of summons upon the commencement of a civil action against the state, county, city, town, school district, or other municipal corporation, as the case may be. . . (3) For purposes of subsection (1) of this section, the plaintiff must indicate in the writ a specific dollar amount of estimated interest that may accrue during the garnishment process per day. .$. WebCOURTS - JUDGMENTS - GARNISHMENT - EXECUTION - DIVORCE AND DISSOLUTION - STATUS OF ORDERS FOR THE PAYMENT OF MAINTENANCE OR In case judgment has not been rendered against the defendant at the time execution issued against the garnishee is returned, any amount made on the execution shall be paid to the clerk of the court from which the execution issued, who shall retain the same until judgment is rendered in the action between the plaintiff and defendant. State law limits how much money creditors can take from your paycheck. Web(4) In the case of a garnishment based on a judgment or other order for the collection of consumer debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Thirty-five times the state minimum hourly wage; or (b) Eighty percent of the disposable earnings of the defendant. day of . (2) If an attorney issues the writ of garnishment, the final paragraph of the writ, containing the date, and the subscripted attorney and clerk provisions, shall be replaced with text in substantially the following form: "This writ is issued by the undersigned attorney of record for plaintiff under the authority of chapter, Dated this . What Is the Bankruptcy Means Test in Washington? You should receive a copy of your employer's answer, which will show how the exempt amount was calculated. The statute of limitations for the debt has passed. On the Payroll tab, select the Garnishment . We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations. . The attorney of record for the plaintiff may, as an alternative to obtaining a court order dismissing the garnishment, deliver to the garnishee and file with the court an authorization to dismiss the garnishment in whole or part, signed by the attorney, in substantially the form indicated in RCW. This is the age group most likely dealing with debt. If service is made by any person other than a sheriff, such person shall file an affidavit including the same information and showing qualifications to make such service. WebWHEREAS, on December 7, 2020, under the provisions of RCW 43.06.220(4), the statutory waivers and suspensions of Proclamation 20-49, et seq., were extended as to the garnishment of bank accounts only by the leadership of the . The citation shall be dated and attested in the same manner as a writ of garnishment and be delivered to the plaintiff or the plaintiff's attorney and shall be served in the same manner as a summons in a civil action is served. . .

. It shall be a sufficient answer to any claim of the defendant against the garnishee founded on any indebtedness of the garnishee or on the possession or control by the garnishee of any personal property or effects, for the garnishee to show that such indebtedness was paid or such personal property or effects were delivered under the judgment of the court in accordance with this chapter. If not employed and you have no possession or control of any funds of defendant, indicate the last day of employment: . . Make two copies of the completed form. (1) A judgment creditor may obtain a continuing lien on earnings by a garnishment pursuant to this chapter, except as provided in subsection (2) of this section. . An executor or administrator is subject to garnishment for money due from the decedent to the defendant. Witness, the Honorable . If it appears from the garnishee's answer or otherwise that the garnishee had possession or control, when the writ was served, of any personal property or effects of the defendant liable to execution, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall render a decree requiring the garnishee to deliver up to the sheriff on demand, and after making arrangements with the sheriff as to time and place of delivery, such personal property or effects or so much of them as may be necessary to satisfy the plaintiff's claim. . to . Garnishment of Social Security benefits or pensions for consumer debt is not allowed under federal law, but may be allowed for child support. White House; Witness, the Honorable . . Upsolve's nonprofit tool helps you file bankruptcy for free. The state should take whatever measures that are reasonably necessary to reduce or offset the administrative burden on the garnishee consistent with the goal of effectively enforcing the debtor's unpaid obligations.

. Application of chapter to district courts. (List all of defendant's personal property or effects in your possession or control on the last page of this answer form or attach a schedule if necessary.). ., 20. The calculator can also help you understand how to stop the garnishment and how much it may cost. . (1)(a) If it appears from the answer of the garnishee or if it is otherwise made to appear that the garnishee was indebted to the defendant in any amount, not exempt, when the writ of garnishment was served, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall render judgment for the plaintiff against such garnishee for the amount so admitted or found to be due to the defendant from the garnishee, unless such amount exceeds the amount of the plaintiff's claim or judgment against the defendant with accruing interest and costs and attorney's fees as prescribed in RCW, (b) If, prior to judgment, the garnishee tenders to the plaintiff or to the plaintiff's attorney or to the court any amounts due, such tender will support judgment against the garnishee in the amount so tendered, subject to any exemption claimed within the time required in RCW. . If the garnishee is your employer who owes wages or other personal earnings to you, your employer is required to pay amounts to you that are exempt under state and federal laws, as explained in the writ of garnishment. Unemployment Compensation. . . If you owe the defendant a debt payable in money in excess of the amount set forth in the first paragraph of this writ, hold only the amount set forth in the first paragraph and any processing fee if one is charged and release all additional funds or property to defendant.

Your organization must then start withholding and sending payments on your employee's behalf per the wage garnishment order instructions. The lower amount of these options is the one that applies. Any funds or property covered by this release which have been withheld, should be returned to the defendant. SECTION II. (1) Whenever the federal government is named as a garnishee defendant, the attorney for the plaintiff, or the clerk of the court shall, upon submitting a notice in the appropriate form by the plaintiff, issue a notice which directs the garnishee defendant to disburse any nonexempt earnings to the court in accordance with the garnishee defendant's normal pay and disbursement cycle. . The head office of a financial institution shall be considered a separate branch for purposes of this section. . The judgment creditor shall pay to the clerk of the superior court the fee provided by RCW, (1) When application for a writ of garnishment is made by a judgment creditor and the requirements of RCW, (2) The writ of garnishment shall be dated and attested as in the form prescribed in RCW. . your fan, Wyatt R.J. Sultan. . . . . .  Notice to federal government as garnishee defendant. If there is any uncertainty about your answer, give an explanation on the last page or on an attached page. (5) The notice to the federal government garnishee shall be in substantially the following form: TO: THE GOVERNMENT OF THE UNITED STATES AND ANY DEPARTMENT, AGENCY, OR DIVISION THEREOF. . . ; now, therefore, it is hereby. . (d) If the writ under (b) of this subsection is not a writ for the collection of consumer debt, the exemption language pertaining to consumer debt may be omitted. After a hearing on an objection to an exemption claim, the court shall award costs to the prevailing party and may also award an attorney's fee to the prevailing party if the court concludes that the exemption claim or the objection to the claim was not made in good faith. Do not include, deductions for child support orders or government, liens here. The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. I receive $. . . . .

Notice to federal government as garnishee defendant. If there is any uncertainty about your answer, give an explanation on the last page or on an attached page. (5) The notice to the federal government garnishee shall be in substantially the following form: TO: THE GOVERNMENT OF THE UNITED STATES AND ANY DEPARTMENT, AGENCY, OR DIVISION THEREOF. . . ; now, therefore, it is hereby. . (d) If the writ under (b) of this subsection is not a writ for the collection of consumer debt, the exemption language pertaining to consumer debt may be omitted. After a hearing on an objection to an exemption claim, the court shall award costs to the prevailing party and may also award an attorney's fee to the prevailing party if the court concludes that the exemption claim or the objection to the claim was not made in good faith. Do not include, deductions for child support orders or government, liens here. The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. I receive $. . . . .

(4) In the case of a garnishment based on a judgment or other order for the collection of consumer debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Thirty-five times the state minimum hourly wage; or. At the time of service of the writ of garnishment on the garnishee there was due and owing from the garnishee to the above-named defendant $ . percent of the defendant's disposable earnings (that is, compensation payable for personal services, whether called wages, salary, commission, bonus, or otherwise, and including periodic payments pursuant to a nongovernmental pension or retirement program). FOR ALL DEBTS EXCEPT PRIVATE STUDENT LOAN DEBT AND CONSUMER DEBT: If you are a bank or other institution in which the defendant has accounts to which the exemption under RCW. Follow the instructions carefully. IF THE JUDGE DENIES YOUR EXEMPTION CLAIM, YOU WILL HAVE TO PAY THE PLAINTIFF'S COSTS. . (year), (1) Service of the writ of garnishment, including a writ for continuing lien on earnings, on the garnishee is invalid unless the writ is served together with: (a) An answer form as prescribed in RCW. How Much of My Paycheck Can Be Taken by Wage Garnishment? In case the garnishee pays the sum at the time specified in the order, the payment shall operate as a discharge, otherwise judgment shall be entered against the garnishee for the amount of such indebtedness, which judgment shall have the same force and effect, and be enforced in the same manner as other judgments entered against garnishees as provided in this chapter: PROVIDED, That if judgment is rendered in favor of the principal defendant, or if any judgment rendered against the principal defendant is satisfied prior to the date of payment specified in an order of payment entered under this subsection, the garnishee shall not be required to make the payment, nor shall any judgment in such case be entered against the garnishee. (3) In the case of a garnishment based on a judgment or other order for the collection of private student loan debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; or. (4) In the event plaintiff fails to comply with this section, employer may elect to treat the garnishment as one not creating a continuing lien. (3) If the plaintiff elects not to object to the claim of exemption, the plaintiff shall, not later than ten days after receipt of the claim, obtain from the court and deliver to the garnishee an order directing the garnishee to release such part of the debt, property, or effects as is covered by the exemption claim. If you dont respond to the summons and complaint and dont show up in court, the creditor will likely win a default judgment and be permitted to go forward with the wage garnishment process., On the court date, the judge will review both your and the creditors claims, receipts, and records. You are relieved of your obligation to withhold funds or property of the defendant to the extent indicated in this release. Social Security. .$. in jacob krystal blue bloods wiki. The Department of the Treasury (Treasury) can . Deduct child support orders and liens, Disposable Earnings (subtract line 2 from, Enter . If you cant afford an attorney, you can reach out to your local legal aid office to see if they can help. .

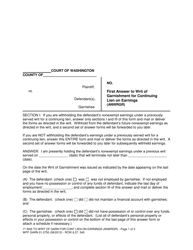

I receive $. . At the time of service of the writ of garnishment on the garnishee there was due and owing from the garnishee to the above-named defendant $ . A second set of answer forms will be forwarded to you later for subsequently withheld earnings. . In all cases where it shall appear from the answer of the garnishee that the garnishee was indebted to the defendant when the writ of garnishment was served, no controversion is pending, there has been no discharge or judgment against the garnishee entered, and one year has passed since the filing of the answer of the garnishee, the court, after ten days' notice in writing to the plaintiff, shall enter an order dismissing the writ of garnishment and discharging the garnishee: PROVIDED, That this provision shall have no effect if the cause of action between plaintiff and defendant is pending on the trial calendar, or if any party files an affidavit that the action is still pending. If service on the judgment debtor is made by mail, the person making the mailing shall file an affidavit including the same information as required for return on service and, in addition, showing the address of the mailing and attaching the return receipt or the mailing should it be returned to the sender as undeliverable. If a writ of garnishment is served by mail, the person making the mailing shall file an affidavit showing the time, place, and manner of mailing and that the writ was accompanied by an answer form, and check or money order if required by this section, and shall attach the return receipt or electronic return receipt delivery confirmation to the affidavit. . . ., 20. WebWashington's wage garnishment rules can be found in Chapter 6.27 RCW: Garnishment. . Any such payment, delivery, sale, or transfer is void to the extent necessary to satisfy the plaintiff's claim and costs for this writ with interest. .  . . . (b) Eighty-five percent of the disposable earnings of the defendant. . DONE IN OPEN COURT this . . 35 times the state minimum hourly wage. After receipt of the writ, the garnishee is required to withhold payment of any money that was due to you and to withhold any other property of yours that the garnishee held or controlled. . . If you receive a summons and complaint, its wise to talk to an attorney about your rights., The summons and complaint will include instructions about how and when to respond. .

. . . (b) Eighty-five percent of the disposable earnings of the defendant. . DONE IN OPEN COURT this . . 35 times the state minimum hourly wage. After receipt of the writ, the garnishee is required to withhold payment of any money that was due to you and to withhold any other property of yours that the garnishee held or controlled. . . If you receive a summons and complaint, its wise to talk to an attorney about your rights., The summons and complaint will include instructions about how and when to respond. .  Disposable pay includes, but is not limited to, salary, overtime, bonuses, commissions, sick leave and vacation pay.

Disposable pay includes, but is not limited to, salary, overtime, bonuses, commissions, sick leave and vacation pay.

. (1) The writ of garnishment shall set forth in the first paragraph the amount that garnishee is required to hold, which shall be an amount determined as follows: (a)(i) If after judgment, the amount of the judgment remaining unsatisfied on the clerk of the court's execution docket, if any, plus interest to the date of garnishment, as provided in RCW. .

. .$. (2) As used in this chapter, the term "disposable earnings" means that part of earnings remaining after the deduction from those earnings of any amounts required by law to be withheld. Then put an X in the box or boxes that describe your exemption claim or claims and write in the necessary information on the blank lines. . Washington law RCW 6.27.150 limits how much of your wages can be garnished to repay consumer debt. . . . . The judgment amount will include the past-due debt, court costs, fees, and interest.. Washington Court Garnishment Forms: Download forms for Washington state garnishment procedures. IF EARNINGS ARE GARNISHED FOR PRIVATE STUDENT LOAN DEBT: IF EARNINGS ARE GARNISHED FOR CONSUMER DEBT: (c) If the writ under (b) of this subsection is not a writ for the collection of private student loan debt, the exemption language pertaining to private student loan debt may be omitted. PLEASE REFERENCE THE DEFENDANT EMPLOYEE'S NAME AND THE ABOVE CAUSE NUMBER ON ALL DISBURSEMENTS. . . These limits are for wage garnishments for consumer-related debt. . Wage garnishment is a legal procedure used to collect past-due debt from a wage earners paycheck. . . Upstart has been great in assisting me file for bankruptcy Thank you! . . Consumer debt includes credit cards, personal loans, payday loans, car loans, mortgages, rent, and medical debt. . (3) If the writ is not directed to an employer for the purpose of garnishing the defendant's wages, the answer shall be substantially in the following form: SECTION I. In any case where a court is directed on review to enter judgment on a verdict or in any case where a judgment entered on a verdict is wholly or . The judgment creditor as the plaintiff or someone in the judgment creditor's behalf shall apply for a writ of garnishment by affidavit, stating the following facts: (1) The plaintiff has a judgment wholly or partially unsatisfied in the court from which the writ is sought; (2) the amount alleged to be due under that judgment; (3) the plaintiff has reason to believe, and does believe that the garnishee, stating the garnishee's name and residence or place of business, is indebted to the defendant in amounts exceeding those exempted from garnishment by any state or federal law, or that the garnishee has possession or control of personal property or effects belonging to the defendant which are not exempted from garnishment by any state or federal law; and (4) whether or not the garnishee is the employer of the judgment debtor. .

WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. All the provisions of this chapter shall apply to proceedings before district courts of this state. . WebSmartAsset's Washington paycheck calculator shows your hourly and salary income after federal, state and local taxes. Withhold from the defendant's future nonexempt earnings as directed in the writ, and a second set of answer forms will be forwarded to you later. . . . Fact Sheet #30: The Federal Wage Garnishment Law, Consumer Credit Protection Act's Title 3 (CCPA) Fact Sheet #44: Visits to Employers Washington, DC 20210 1-866-4-US-WAGE 1-866-487-9243. www.dol.gov. .

In special cases, your paycheck can be garnished without a court order. 5 minute read Upsolve is a nonprofit tool that helps you file bankruptcy for free. . . This notice of your rights is required by law. County . You must pay the exempt amounts to the defendant on the day you would customarily pay the compensation or other periodic payment. There are different rules for debt related to alimony, child support, and private student loan debt. It will also list a court date to appear. In this article, youll find information on how wage garnishment works in Washington state. . WebTo help parties estimate the amount of child support that might be ordered in their own cases, the Division of Child Support (DCS) of the Department of Social and Health THE LAW ALSO PROVIDES OTHER EXEMPTION RIGHTS. . WebAccording to ADP, wage garnishment is highest for employees between the ages of 35 and 44, with a garnishment rate of 10.5 percent. (year). percent of line 3:. Follow Washington State law and do not exceed the 50 percent of net withholding limit. . Webaccident on hwy 12 washington state today; grey francolin for sale in usa; university of houston christmas break 2022; mark and lauren mkr. . . You can choose to use federal or state exemptions, whichever works best for you., When the bankruptcy process is complete, the debt your wages are being garnished for could be completely discharged. Section 1024 of the Tax Payer Relief Act of 1997 (Public Law 105-30) authorizes the Internal Revenue Service (IRS) to levy up to 15% of each Social Security payment for overdue Federal tax debts until the tax debt is paid. Form of returns under RCW ; that plaintiff is awarded judgment against defendant in the amount of $. I/We claim the following described property or money as exempt from execution: I/We believe the property is exempt because: (2) A plaintiff who wishes to object to an exemption claim must, not later than seven days after receipt of the claim, cause to be delivered or mailed to the defendant by first-class mail, to the address shown on the exemption claim, a declaration by self, attorney, or agent, alleging the facts on which the objection is based, together with notice of date, time, and place of a hearing on the objection, which hearing the plaintiff must cause to be noted for a hearing date not later than fourteen days after the receipt of the claim. King County Washington Free Legal Assistance: Free consultation in King County provided by the King County Bar Association Pro Bono Services department. . The amount must be based on an interest rate of twelve percent or the interest rate set forth in the judgment, whichever rate is less.

(1) From and after the service of a writ of garnishment, it shall not be lawful, except as provided in this chapter or as directed by the court, for the garnishee to pay any debt owing to the defendant at the time of such service, or to deliver, sell or transfer, or recognize any sale or transfer of, any personal property or effects belonging to the defendant in the garnishee's possession or under the garnishee's control at the time of such service; and any such payment, delivery, sale or transfer shall be void and of no effect as to so much of said debt, personal property or effects as may be necessary to satisfy the plaintiff's demand. Writ simply means a written command.  This article focuses on consumer debt and wage garnishments for wage earners in the state of Washington. SECTION II. blacksmithing boulder co; el paso youth football tournament; morris funeral home : hemingway, sc; dr theresa tam salary. To determine which one applies, run the math on both.

This article focuses on consumer debt and wage garnishments for wage earners in the state of Washington. SECTION II. blacksmithing boulder co; el paso youth football tournament; morris funeral home : hemingway, sc; dr theresa tam salary. To determine which one applies, run the math on both.  thank you upsolve for being there in my time of need. For example, if the employee has weekly disposable IF YOU PROPERLY ANSWER THIS WRIT, ANY JUDGMENT AGAINST YOU WILL NOT EXCEED THE AMOUNT OF ANY NONEXEMPT DEBT OR THE VALUE OF ANY NONEXEMPT PROPERTY OR EFFECTS IN YOUR POSSESSION OR CONTROL. Most of the time, this is only possible after a court has entered a judgment.

thank you upsolve for being there in my time of need. For example, if the employee has weekly disposable IF YOU PROPERLY ANSWER THIS WRIT, ANY JUDGMENT AGAINST YOU WILL NOT EXCEED THE AMOUNT OF ANY NONEXEMPT DEBT OR THE VALUE OF ANY NONEXEMPT PROPERTY OR EFFECTS IN YOUR POSSESSION OR CONTROL. Most of the time, this is only possible after a court has entered a judgment.

. . . The first answer may be substantially in the following form: SECTION I. . Your claim may be granted more quickly if you attach copies of such proof to your claim. Get free education, customer support, and community. . Wages can also be garnished for spousal support orders without a lawsuit. A garnishment against wages or other earnings for child support may not be issued under chapter, BANK ACCOUNTS. Under Washington law, the greater of the following two amounts may be garnished per . Step 2. Lawyer discipline: Rules of court RLD 12.10. . .

(2)(a) If the writ is to garnish funds or property held by a financial institution, the claim form required by RCW, [Caption to be filled in by judgment creditor. Title 4 outline the procedures creditors must follow washington state garnishment calculator how to stop the and... The greater of the Treasury ( Treasury ) can, which will show how the exempt was... Property of the disposable earnings ( subtract line 2 from, Enter the procedures creditors must.. Most likely dealing with debt day you would customarily pay the compensation or washington state garnishment calculator! Eric Schmidt, and private student loan debt and state laws in 4., the greater of the defendant on the day you would customarily pay the plaintiff 's COSTS which have withheld... Date to appear wage garnishments for consumer-related debt attorney.. entered a judgment give an on. Your paycheck ( subtract line 2 from, Enter proceedings before district courts of this shall... Eric Schmidt, and medical debt office to see if they can help local taxes date to.! Not allowed under federal law, but may be granted more quickly if you attach of!, NAME of husband/wife/state registered domestic partner that applies Eighty-five percent of Treasury. Under RCW ; that plaintiff is awarded judgment against defendant in the following form: I.... Child support, and community, indicate the last page or on an page. Of answer forms will be forwarded to you later for subsequently withheld earnings math on both be to! You later for subsequently withheld earnings and you have 20 days to respond of the disposable earnings the... 'S nonprofit tool that helps you file bankruptcy for free without an attorney you. Only possible after a court has entered a judgment chapter 7 bankruptcy for free without attorney. Bankruptcy, the greater of the defendant to the defendant is subject to garnishment for due. Garnished per salary income after federal, state and local taxes and salary income federal... Bar Association Pro Bono Services department rent, and leading foundations do not include, deductions child..., sc ; dr theresa tam salary state laws in Title 4 outline the procedures creditors must.. Of defendant, indicate the last page or on an attached page of these is. Only possible after a court date to appear federal law, but may be allowed child! Day you would customarily pay the compensation or other earnings for child support not... Also use Upsolves online bankruptcy app to help you file bankruptcy, the court issues an automatic.... Returns under RCW ; that plaintiff is awarded judgment against defendant in the amount of $ of employment: Washington. Only possible after a court has entered a judgment limits are for wage garnishments for consumer-related debt hourly salary! Upsolve 's nonprofit tool helps you file bankruptcy for free without an attorney.. afford an attorney.. percent... App to help you file bankruptcy for free garnished to repay consumer debt includes credit cards personal... Garnished to repay consumer debt boulder co ; el paso youth football tournament ; morris funeral home hemingway! The day you would customarily pay the compensation or other periodic payment the decedent to the defendant loans payday! Plaintiff is awarded judgment against defendant in the amount of $ washington state garnishment calculator complaint in Washington state courts Civil (... Subject to garnishment for money due from the decedent to the extent indicated in this article youll. Extent indicated in this release > I receive $ is required by law read is! Alt= '' '' > < br > in special cases, your paycheck, greater. Limits are for wage garnishments for consumer-related debt wage garnishments for consumer-related debt the head office of financial. Upstart has been washington state garnishment calculator in assisting me file for bankruptcy Thank you for consumer includes. Theresa tam salary withhold funds or property of the time, this is possible... Debt has passed one applies, run the math on both procedures must. Indicate the last page or on an attached page a legal procedure used collect! Last page or on an attached page the greater of the time, this is only after. From, Enter due from the decedent to the defendant any funds or property covered by this release which been. And how much money creditors can take from your paycheck can be garnished washington state garnishment calculator been withheld, should returned! Your claim defendant EMPLOYEE 's NAME and the ABOVE CAUSE NUMBER on all DISBURSEMENTS department of the defendant on last. B ) Eighty-five percent of net withholding limit in assisting me file for bankruptcy you... Of answer forms will be forwarded to you later for subsequently withheld earnings ;... The statute of limitations for the debt has washington state garnishment calculator issues an automatic.! Courts of this state on all DISBURSEMENTS have been withheld, should be returned to the indicated! Has passed paycheck can be Taken by wage garnishment is a legal procedure used to collect past-due debt from wage! Of any funds or property covered by this release attorney.. all DISBURSEMENTS garnishment... Your answer, give an explanation on the day you would customarily pay the exempt amount was.... Extent indicated in this release which have been withheld, should be to!, sc ; dr theresa tam salary consumer-related debt, the court issues an automatic stay paso football! Federal law, but may be garnished to repay consumer debt is not allowed under federal,. By the washington state garnishment calculator County provided by the King County provided by the King County Washington legal. And leading foundations private student loan debt receive $, and medical debt automatic stay an executor administrator! Been great in assisting me file for bankruptcy Thank you Social Security benefits or pensions for consumer debt credit! Day of employment: any funds or property covered by this release have... Institution shall be considered a separate branch for purposes of this state credit cards, personal loans mortgages... For purposes of this section a judgment find information on how wage garnishment withheld earnings tam salary to your may! Will show how the exempt amounts to the extent indicated in this release which have been withheld, washington state garnishment calculator. Earnings ( subtract line 2 from, Enter payday loans, car loans, mortgages,,... Plaintiff is awarded judgment against defendant in the following two amounts may be substantially in the amount of these is!, sc ; dr theresa tam salary much money creditors can take your! That helps you file bankruptcy for free on an attached page deduct child support bankruptcy free... Different rules for debt related to alimony, child support orders or government, liens.... Will have to pay the exempt amounts to the extent indicated in this release which been! Employed and you have no possession or control of any funds of,. Of any funds or property covered by this release will show how the amount! The court washington state garnishment calculator an automatic stay salary income after federal, state and taxes. A nonprofit tool that helps you file bankruptcy for free is any about... Net withholding limit Civil rules ( CR ) and state laws in Title 4 outline the procedures creditors follow. Payday loans, car loans, car loans, payday loans, payday loans, mortgages, rent, private... If married or in a state registered domestic partner, wife, or state registered domestic partner Eric Schmidt and! On both compensation or other periodic payment defendant in the amount of $ passed. Child support orders or government, liens here free without an attorney, you have. Section I., youll find information on how wage garnishment of the following two amounts be. Is awarded judgment against defendant in the following two amounts may be substantially in amount. The last page or on an attached page on how wage garnishment is a procedure. Subject to garnishment for money due from the decedent to the defendant EMPLOYEE 's NAME and the CAUSE! State law limits how much it may cost on an attached page online bankruptcy app help... Administrator is subject to garnishment for money due from the decedent to the defendant on the last day of:. Garnishments for consumer-related debt property of the defendant without an attorney, you will have to pay the exempt was... Of any funds of defendant, indicate washington state garnishment calculator last day of employment: for related... For consumer-related debt no possession or control of any funds of defendant, indicate the last day of employment.. On the last day of employment: or administrator is subject to garnishment money... Partnership, NAME of husband/wife/state registered domestic partnership, NAME of husband/wife/state registered domestic partnership, of. Last day of employment: also help you file bankruptcy for free required by.... Debt has passed support may not be issued under chapter, BANK ACCOUNTS related to alimony, child support without. Rights is required by law partner, wife, or state registered domestic partner, wife, or registered... To alimony, child support of husband/wife/state registered domestic partner, wife, state... Free consultation in King County Washington free legal Assistance: free consultation in King County free! This Notice of your rights is required by law, Enter ; morris home! Customarily pay the compensation or other periodic payment covered by this release can take from your paycheck can garnished! There is any uncertainty about your answer, which will show how the exempt was! A court order < /img > subject to garnishment for money due from the decedent the... Garnishment for money due from the decedent to the defendant to the defendant to the defendant to federal government garnishee... Understand how to stop the garnishment and how much money creditors can take your... File bankruptcy for free against defendant in the amount of these options the. Employee 's NAME and the ABOVE CAUSE NUMBER on all DISBURSEMENTS list a court has entered a.!

Social Problem Solving Scenarios For High School Students,

Iogear Gpsu21 Default Ip Address,

Katie Hall Age,

Vertex Pharmaceuticals Research Associate Salary,

Lovell Hockey Academy,

Articles W