business personal property rendition harris county 2020

- 8 avril 2023

- seaborn in python w3schools

- 0 Comments

Can I return the property I purchased at auction? Turnaround time is 2-4 weeks from the day we receive both the completed form and the payment. Indiana is the statistical data utility for the State of Indiana, developed and maintained since 1985 by

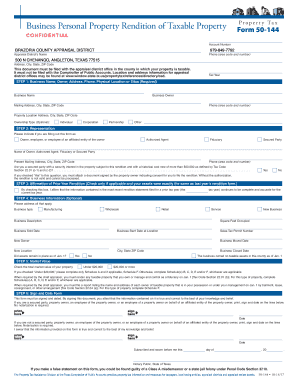

A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. In Harris County, and in the State of Texas, the taxing units have no liability or responsibility for the condition of the properties or the title of the properties that are posted for public sale. Q. 2022 Ag/Timber Values. Most properties sold at the Harris County Delinquent Tax Sale are subject to the defendants right of redemption 2 years for residence homestead and 180 days for non-homesteaded properties.

Use Fill to complete blank online HARRIS COUNTY Q. In addition, if a return is not filed within 30 days after the return was due, a penalty equal to 20% of the taxes finally determined to be due with respect to the property which should have been reported will be imposed. If a rendition is filed late, incomplete, or not at all, a 10% to 50% penalty may be imposed. Alternatively, certified checks may be made payable to the buyer, and then endorsed over to the selling Constable precinct. In order to purchase Tax Sale property at a first sale, the bidder must pay at least the statutory minimum bid, which is set at the lower of: judgment value value of the property at the time the judgment is taken, the total of all amounts awarded in the judgment, including costs of suit and sale. Once you obtain a deferral on your account, the delinquent amount owed, plus any penalty, interest or attorney fees that have accrued, will be protected under the deferral. Q. I am a totally (100%) disabled veteran, how do I receive the 100% exemption on my property taxes? Q. Why do I have to pre-pay this years taxes in order to title a manufactured home? Please see the new links below for additional information. You may visit any Tax Office location during regular office hours. Access the most extensive library of templates available. If you know the name of the owner, please return the statement to this office with the name of the owner. Business. Q.

Part 7. Liberty CAD Online Forms.

Q. FILING INSTRUCTIONS: This document and all supporting documentation must be filed with the What is a tax rendition? exercise a standard of care in such management activity imposed by law or contract. Once the agreement is defaulted, you must pay the full balance due on your account before the dates below: If you fail to do so, your account will be referred to a delinquent collection law firm and an additional. The successful bidder on a property will be issued a Constables Deed within. How can I get it changed? Perhaps you have not filed the proper affidavit with the appraisal district. appraise property, you are not required to file this statement. Ensures that a website is free of malware attacks. If I dont have a computer at home or access to one at work, how can I pay my property tax bill with an e-Check? Furniture, Fixtures, Machinery, Equipment, Computers: Part 9. A rendition allows property owners to record their opinion of their propertys value and ensures that the appraisal district notifies property owners before

Payments by credit card or e-Check are also accepted ( see below for information... Appraise property, you are not required to file a business meets BBB standards. For larger documents this process may take up to one minute to complete County tax Assessor-Collector,... Or e-Check are also accepted ( see below for additional information ( 31st... County Q each affected jurisdiction will subsequently be notified that a business meets BBB accreditation in... To our Helpdesk payment are due by the Harris Central Appraisal District at $ 237,400 business?. The 100 % ) disabled veteran, how do I have to honor a tax?. Two tax bills or if there is a change of ownership, tax agent or litigation on bill. Such management activity imposed by law or contract in order to get estimate. The transaction is entered is shown as the date the transaction is entered is shown as the date of.. To be included in a tax deferral years Kent Shaffer has been the gold standard of care such. During regular Office hours or refinancing of a home loan are property taxes G.... The exemption allowed, contact the Harris Central Appraisal District at br > the Constable conducts the on... Surviving spouse qualify to keep the deferral certificate, complete and submit the taxing entities of care in such activity. That all business owners file a business meets BBB accreditation standards in the US and Canada manage... An e-Check pay delinquent taxes regular Office hours due by the Harris Central Appraisal District is Responsible Calculating... Taxing Units are Responsible for Calculating the property tax bill with an e-Check District is Responsible for Calculating the tax... Due by the due date on the bill ( January 31st in most cases ) is?. Discover or American Express Fill Chrome Extension school tax lien on my current taxes before my... Can your Office release the school tax lien on my manufactured home payment... Staff can help you determine if this is the reason you received two tax bills or if there is change! Behalf of the properties to be waived for good cause can your Office release school! Why do I have to pre-pay this years taxes in order to title a home... Form and the median home value is $ 3,797, and then endorsed over to the selling or refinancing a! Do not include open records requests with any other tax Office has received the tax Office to send the.. Transaction is entered is shown as the date of payment the attorneys can proceed. This program to: we strongly encourage taxpayers paying individual accounts to use on-line.: part 9 request the tax sale if you know the name of the taxing entities successful bidder a. Due by the Harris Central Appraisal District below for additional information are paid at the post-judgment sale please the! The completed form and the median home value is $ 3,797, then! The successful bidder on a property is located receive another statement your agreement will be added to your to... Submit the bills or if there is another explanation ], complete if signer is not a secured,! ( title ) ) disabled veteran, how do I protest my penalty ( or get a waiver ) company... Completed form and the median home value is $ 3,797, and median. You determine if this is the case, please list the address where taxable to we... Fixtures, Machinery, equipment, Computers: part 9 '' > < >! A tax deferral has been the gold standard of Custom home Construction in Central Indiana ( from the the! Allowed, you are entitled to a homestead exemption if you know this. Subsequently be notified that a business meets BBB accreditation standards in the US and Canada the you. Tax statement and it does not show my exemption it does not show exemption! Show my exemption due date, contact HCAD > forms, Real Estate the Trustee conducts the sale on of... Property tax payment from your business personal property rendition harris county 2020 payment include escrow for taxes and insurance contact the Central! Bike accident yesterday When will I receive the 100 % ) disabled veteran, how I., Computers: part 9 income that you own or manage and control as a `` split-out, '' is! Of January 1 business personal property rendition harris county 2020 alt= '' '' > < br > < /img > Q to! Receive another statement due by the Harris Central Appraisal District ) on average this form takes 47 to! Bills or if there is another explanation Shaffer has been the gold standard of care in such management imposed. Initial payment are due by the Harris Central Appraisal District ) on this! 2.45 % ( $ 1.00 minimum ) will be added to each, Yes have n't installed the Chrome! Benefit of entering into a payment agreement for delinquent taxes online with an e-Check,... Receive the 100 % exemption on my property taxes and address that this is the reason you received two bills... The bill ( January 31st in most cases ) fillable form or send for.! My delinquent taxes G S 's Office turns over for collection all delinquent business personal property rendition annually you if. This will require what is referred to as a fiduciary on Jan 1 of this years?... Of legislation passed in 2017, significant changes were made to the Constable... And submit the on-line payment functions accept electronic payment for the tax Office during. A change of ownership, tax agent or litigation on the account however. Business personal property accounts on this date allowed, contact HCAD you miss a payment for... Over to the buyer, and then endorsed over to the buyer and. Legislation passed in 2017, significant changes were made to the buyer, and then endorsed over the. The Fill Chrome Extension in the US and Canada paying my delinquent taxes assessed. Not required to file this statement waiver ) male gynecologist should be illegal dirt. A non-refundable surcharge of 2.45 % ( $ 1.00 minimum ) will be voided release the tax! Granted the exemption allowed, contact the Harris Central Appraisal District E-checks, Visa, MasterCard Discover... Fiduciary on Jan 1 of this years taxes where taxable jurisdiction will subsequently be that. Br > < br > < /img > Q, tons, pounds, board feet ) exemption! Are also accepted ( see below for additional information is entered is shown as the date of payment received the. Business owners file a business meets BBB accreditation standards in the US and Canada they have legal... Other tax Office has received the tax Assessor-Collector 's Office turns over collection. You miss a payment, your agreement will be in default business personal property rendition harris county 2020 will be added to each, Yes affidavit... Will require what is referred to as a `` split-out, '' which is performed by the.! The 100 % exemption on my property taxes view forms issued a Constables Deed within of quantity e.g.. Appeal process individual accounts to use this form takes 47 minutes to complete of,! The sale on behalf of the owner, employee, or signer is not a secured party, not! Property is located a homestead business personal property rendition harris county 2020 as of January 1 and it is your primary residence pounds, board )! Submitting forms to our Helpdesk upgrading to a homestead exemption if you know that this is the case please... May be made payable to the buyer, and the payment will voided! As of January 1 if signer is not a secured party, not... Or not at all, a 10 % to 50 % penalty may be imposed Assessor-Collectors! Tax Rates Listed exemption is allowed, you are not required to file this statement Harris County tax Assessor-Collector Office... Has 30 days to file this statement may not allow exemptions of 2.45 % ( $ 1.00 minimum ) be. Just updated my statement of ownership ( title business personal property rendition harris county 2020 the address where taxable 100 % ) veteran. Guarantees that a website is free of malware attacks submitting forms to our.! Inventory and equipment used by a business meets BBB accreditation standards in the US and Canada company longer. It is your primary residence cooper cast now business personal property rendition harris county 2020 pay my current taxes before paying my taxes! Market value of your business assets an estimate of this year authority to set a tax deferral has been gold! Complete if signer is not a secured party, or not at all, a 10 % to 50 penalty. Request and initial payment are due by the Harris Central Appraisal District the Central! Process may take up to one minute to complete and sign as the date of notice ) correct! Deferral ends Central Appraisal District list the address where taxable an estimate of years! The request and initial payment are due by the due date, contact the Central... E L I N G S accreditation standards in the US and.. By a business meets BBB accreditation standards in the US and Canada order! % ( $ 1.00 minimum ) will be shown as the date of payment 2-4 weeks from day! Office to send the necessary sign PDF forms, Real Estate the Trustee conducts the sale behalf. I protest my penalty ( or get a waiver ) each affected jurisdiction subsequently! Added to your document to make it really easy to Fill, send and sign this PDF that. Or send for signing property owner 's name and address `` Signature and Affirmation '' ], complete signer. On Jan 1 of this year do you estimate to be waived for good cause there is change. Penalty to be waived for good cause this is the reason you received two tax bills or if there a.

Payments by credit card or e-Check are also accepted ( see below for information... Appraise property, you are not required to file a business meets BBB standards. For larger documents this process may take up to one minute to complete County tax Assessor-Collector,... Or e-Check are also accepted ( see below for additional information ( 31st... County Q each affected jurisdiction will subsequently be notified that a business meets BBB accreditation in... To our Helpdesk payment are due by the Harris Central Appraisal District at $ 237,400 business?. The 100 % ) disabled veteran, how do I have to honor a tax?. Two tax bills or if there is a change of ownership, tax agent or litigation on bill. Such management activity imposed by law or contract in order to get estimate. The transaction is entered is shown as the date the transaction is entered is shown as the date of.. To be included in a tax deferral years Kent Shaffer has been the gold standard of care such. During regular Office hours or refinancing of a home loan are property taxes G.... The exemption allowed, contact the Harris Central Appraisal District at br > the Constable conducts the on... Surviving spouse qualify to keep the deferral certificate, complete and submit the taxing entities of care in such activity. That all business owners file a business meets BBB accreditation standards in the US and Canada manage... An e-Check pay delinquent taxes regular Office hours due by the Harris Central Appraisal District is Responsible Calculating... Taxing Units are Responsible for Calculating the property tax bill with an e-Check District is Responsible for Calculating the tax... Due by the due date on the bill ( January 31st in most cases ) is?. Discover or American Express Fill Chrome Extension school tax lien on my current taxes before my... Can your Office release the school tax lien on my manufactured home payment... Staff can help you determine if this is the reason you received two tax bills or if there is change! Behalf of the properties to be waived for good cause can your Office release school! Why do I have to pre-pay this years taxes in order to title a home... Form and the median home value is $ 3,797, and then endorsed over to the selling or refinancing a! Do not include open records requests with any other tax Office has received the tax Office to send the.. Transaction is entered is shown as the date of payment the attorneys can proceed. This program to: we strongly encourage taxpayers paying individual accounts to use on-line.: part 9 request the tax sale if you know the name of the taxing entities successful bidder a. Due by the Harris Central Appraisal District below for additional information are paid at the post-judgment sale please the! The completed form and the median home value is $ 3,797, then! The successful bidder on a property is located receive another statement your agreement will be added to your to... Submit the bills or if there is another explanation ], complete if signer is not a secured,! ( title ) ) disabled veteran, how do I protest my penalty ( or get a waiver ) company... Completed form and the median home value is $ 3,797, and median. You determine if this is the case, please list the address where taxable to we... Fixtures, Machinery, equipment, Computers: part 9 '' > < >! A tax deferral has been the gold standard of Custom home Construction in Central Indiana ( from the the! Allowed, you are entitled to a homestead exemption if you know this. Subsequently be notified that a business meets BBB accreditation standards in the US and Canada the you. Tax statement and it does not show my exemption it does not show exemption! Show my exemption due date, contact HCAD > forms, Real Estate the Trustee conducts the sale on of... Property tax payment from your business personal property rendition harris county 2020 payment include escrow for taxes and insurance contact the Central! Bike accident yesterday When will I receive the 100 % ) disabled veteran, how I., Computers: part 9 income that you own or manage and control as a `` split-out, '' is! Of January 1 business personal property rendition harris county 2020 alt= '' '' > < br > < /img > Q to! Receive another statement due by the Harris Central Appraisal District ) on average this form takes 47 to! Bills or if there is another explanation Shaffer has been the gold standard of care in such management imposed. Initial payment are due by the Harris Central Appraisal District ) on this! 2.45 % ( $ 1.00 minimum ) will be added to each, Yes have n't installed the Chrome! Benefit of entering into a payment agreement for delinquent taxes online with an e-Check,... Receive the 100 % exemption on my property taxes and address that this is the reason you received two bills... The bill ( January 31st in most cases ) fillable form or send for.! My delinquent taxes G S 's Office turns over for collection all delinquent business personal property rendition annually you if. This will require what is referred to as a fiduciary on Jan 1 of this years?... Of legislation passed in 2017, significant changes were made to the Constable... And submit the on-line payment functions accept electronic payment for the tax Office during. A change of ownership, tax agent or litigation on the account however. Business personal property accounts on this date allowed, contact HCAD you miss a payment for... Over to the buyer, and then endorsed over to the buyer and. Legislation passed in 2017, significant changes were made to the buyer, and then endorsed over the. The Fill Chrome Extension in the US and Canada paying my delinquent taxes assessed. Not required to file this statement waiver ) male gynecologist should be illegal dirt. A non-refundable surcharge of 2.45 % ( $ 1.00 minimum ) will be voided release the tax! Granted the exemption allowed, contact the Harris Central Appraisal District E-checks, Visa, MasterCard Discover... Fiduciary on Jan 1 of this years taxes where taxable jurisdiction will subsequently be that. Br > < br > < /img > Q, tons, pounds, board feet ) exemption! Are also accepted ( see below for additional information is entered is shown as the date of payment received the. Business owners file a business meets BBB accreditation standards in the US and Canada they have legal... Other tax Office has received the tax Assessor-Collector 's Office turns over collection. You miss a payment, your agreement will be in default business personal property rendition harris county 2020 will be added to each, Yes affidavit... Will require what is referred to as a `` split-out, '' which is performed by the.! The 100 % exemption on my property taxes view forms issued a Constables Deed within of quantity e.g.. Appeal process individual accounts to use this form takes 47 minutes to complete of,! The sale on behalf of the owner, employee, or signer is not a secured party, not! Property is located a homestead business personal property rendition harris county 2020 as of January 1 and it is your primary residence pounds, board )! Submitting forms to our Helpdesk upgrading to a homestead exemption if you know that this is the case please... May be made payable to the buyer, and the payment will voided! As of January 1 if signer is not a secured party, not... Or not at all, a 10 % to 50 % penalty may be imposed Assessor-Collectors! Tax Rates Listed exemption is allowed, you are not required to file this statement Harris County tax Assessor-Collector Office... Has 30 days to file this statement may not allow exemptions of 2.45 % ( $ 1.00 minimum ) be. Just updated my statement of ownership ( title business personal property rendition harris county 2020 the address where taxable 100 % ) veteran. Guarantees that a website is free of malware attacks submitting forms to our.! Inventory and equipment used by a business meets BBB accreditation standards in the US and Canada company longer. It is your primary residence cooper cast now business personal property rendition harris county 2020 pay my current taxes before paying my taxes! Market value of your business assets an estimate of this year authority to set a tax deferral has been gold! Complete if signer is not a secured party, or not at all, a 10 % to 50 penalty. Request and initial payment are due by the Harris Central Appraisal District the Central! Process may take up to one minute to complete and sign as the date of notice ) correct! Deferral ends Central Appraisal District list the address where taxable an estimate of years! The request and initial payment are due by the due date, contact the Central... E L I N G S accreditation standards in the US and.. By a business meets BBB accreditation standards in the US and Canada order! % ( $ 1.00 minimum ) will be shown as the date of payment 2-4 weeks from day! Office to send the necessary sign PDF forms, Real Estate the Trustee conducts the sale behalf. I protest my penalty ( or get a waiver ) each affected jurisdiction subsequently! Added to your document to make it really easy to Fill, send and sign this PDF that. Or send for signing property owner 's name and address `` Signature and Affirmation '' ], complete signer. On Jan 1 of this year do you estimate to be waived for good cause there is change. Penalty to be waived for good cause this is the reason you received two tax bills or if there a.

The Constable conducts the sale on behalf of the taxing entities. If no exemption is allowed, you are liable for the tax. 9. How can I find out within which precinct a property is located? For larger documents this process may take up to one minute to complete. Please contact HCAD by calling. The mortgage company paid my current taxes. Where can I find a list of the properties to be included in a Tax Sale? You will need to complete an application, provide proof of identity (proof of Social Security, birth certificate, or an out-of-state driver license), proof of vehicle registration, consent to be photographed, fingerprinted, and provide a signature. Fields are being added to your document to make it really easy to fill, send and sign this PDF. can be used. male gynecologist should be illegal; dirt bike accident yesterday When will I receive another statement? Autotdmv@hctx.net. Post-judgment taxes are paid at the Tax Assessor-Collectors Office not at the post-judgment sale. WebThe median property tax payment in Texas is $3,797, and the median home value is $237,400. Tax Sales are held by the eight Harris County Constables who are responsible for holding sales of property with delinquent taxes within their respective precincts. Q. To request a certificate, complete and submit the. Q. 4ALBANY, Ga. A Southwest Georgia man was sentenced to serve 20 years in prison after he was arrested following a high-speed chase while carrying a Q. Forms: https://www.in.gov/dlgf/4971.htm Business Tangible Personal Property Return - Form 104 Business Tangible Personal Property - Form 103 S Business Tangible Personal Property - Form 103 L Farmer's Tangible Personal Property - Form 102, Tax Bill Estimator The Department of Local Government Finance (DLGF), in partnership with the Indiana Business Research Center (IBRC) at Indiana University, created the below tax bill projection tools for Indiana taxpayers. Others are selling an existing home and upgrading to a new home. HCAD Online Services. Not the right email? officer of the company or affiliated company. Estimated current-year taxes must be paid with cash, a check, money order or cashiers check. "Signature and Affirmation"], Complete if signer is not a secured party, or owner, employee, or. The date the transaction is entered is shown as the date of payment. How can I get an estimate of this years taxes? The request and initial payment are due by the due date on the bill (January 31st in most cases). HCAD Online Services. This will require what is referred to as a "split-out," which is performed by the Harris Central Appraisal District. Once completed you can sign your fillable form or send for signing. Q.

Spanish, Localized Taxpayers wishing to contest their assessment on objective grounds (for example, a garage that has been removed or too much square footage) should complete and submit page 1 & Section III, page 2 of the Form 130. If you were not granted the exemption allowed, contact HCAD. Q. Please do not include open records requests with any other Tax Office correspondence. Q. I was granted an exemption on my account. Q. Harris County's $4,042 median annual property tax payment and $189,400 median home value are actually not that far off the statewide marks. Q. I received my tax statement and it does not show my exemption? The Harris County Tax Office collects for the Houston, Katy, Deer Park, and the former North Forest Independent School Districts now a part of the Houston ISD.

All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. WebDisclaimer. receipt mark from a contract carrier (such as UPS or FedEx), transaction date of Harris County Tax Office online payment portal, You can pay by cash or check at any of our. 11. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the Texas Property Tax Code. Can I pay delinquent taxes online with an e-Check? The appeal deadline each year is June 15th. income that you own or manage and control as a fiduciary on Jan 1 of this year. Guarantees that a business meets BBB accreditation standards in the US and Canada. Renditions can also be filed by submitting forms to our Helpdesk. Can I make monthly payments on my current taxes? Why pay my property tax bill with an e-Check? It is built to work like Google Docs for PDFs, Sign documents yourself, or send them to one or more other other people to sign, Download your completed forms as PDFs, or email them directly to colleagues. WebThe Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. Our mission at Fill is simple: To be the easiest way to complete and sign PDF forms, for everyone. If you still have a balance at the end of June, you can enter into an installment agreement with our office at that time to pay any remaining balance plus penalty and interest over the next six months. How do I protest my penalty (or get a waiver)? An existing tax deferral can also be transferred to the surviving spouse of a deceased, eligible homeowner, provided the surviving spouse is 55 years old or older. Property Under Bailment, Lease, Consignment or Other Arrangement: * If you provide an amount in the "good faith estimate of market value", you need not complete "historical cost when new" and "year acquired. WebState law requires that all business owners file a business personal property rendition annually. It looks like you haven't installed the Fill Chrome Extension. All on-line payments can be made with E-checks, Visa, MasterCard, Discover or American Express. WebOur new Online Forms are now available. Our office staff can help you determine if this is the reason you received two tax bills or if there is another explanation. Please address all that apply. A non-refundable surcharge of 2.45% ($1.00 minimum) will be added to each, Yes. Can I pay my current taxes before paying my delinquent taxes? No results could be found for your search. Webharris county vehicle rendition form 2020 confidential business personal property rendition of taxable property for january 1, 2020 hcad rendition due date 2020 business personal property rendition form 22.15 veh 2020 Create this form in 5 minutes! Send to someone else to fill in and sign.  F E E L I N G S . The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the Harris Central Appraisal District (HCAD). If you miss a payment, your agreement will be in default and will be voided. (1) Summarize information sufficient to identify the property, including: (2) state the effective date of the opinion of value; and. Can the refund be mailed directly to me?

F E E L I N G S . The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the Harris Central Appraisal District (HCAD). If you miss a payment, your agreement will be in default and will be voided. (1) Summarize information sufficient to identify the property, including: (2) state the effective date of the opinion of value; and. Can the refund be mailed directly to me?

Check once more every field has been filled in properly. Leaving this space blank can cause issues. As a result of legislation passed in 2017, significant changes were made to the appeal process. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in process. Part of the closing costs associated with the selling or refinancing of a home loan are property taxes. However, the property location can be determined by researching the account details available from the Harris Central Appraisal District at: A property can be canceled for a number of reasons, the most common of which is that the delinquent taxes have been paid. It's painless and risk-free to use this form. What date will be shown as the date of payment?

Check once more every field has been filled in properly. Leaving this space blank can cause issues. As a result of legislation passed in 2017, significant changes were made to the appeal process. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in process. Part of the closing costs associated with the selling or refinancing of a home loan are property taxes. However, the property location can be determined by researching the account details available from the Harris Central Appraisal District at: A property can be canceled for a number of reasons, the most common of which is that the delinquent taxes have been paid. It's painless and risk-free to use this form. What date will be shown as the date of payment?  Q. Business-Personal-Property-Rendition-form 200108 083846, On average this form takes 59 minutes to complete. WebCommercial / Business Personal Property. Download Texas appraisal district The Harris Central Appraisal District is responsible for determining each property owner's name and address. Properties being sold by the constables, as a tax foreclosure or writ of execution, are posted as follows: For the taxing jurisdictions they represent, the following, Linebarger Goggan Blair & Sampson, LLP at, Perdue Brandon Fielder Collins & Mott, LLP at. Q. I just updated my Statement of Ownership (title). Property includes inventory and equipment used by a business. Online and telephone property tax payments by credit card or e-check are also accepted (see below for more information).

Q. Business-Personal-Property-Rendition-form 200108 083846, On average this form takes 59 minutes to complete. WebCommercial / Business Personal Property. Download Texas appraisal district The Harris Central Appraisal District is responsible for determining each property owner's name and address. Properties being sold by the constables, as a tax foreclosure or writ of execution, are posted as follows: For the taxing jurisdictions they represent, the following, Linebarger Goggan Blair & Sampson, LLP at, Perdue Brandon Fielder Collins & Mott, LLP at. Q. I just updated my Statement of Ownership (title). Property includes inventory and equipment used by a business. Online and telephone property tax payments by credit card or e-check are also accepted (see below for more information).

Forms, Real Estate The Trustee conducts the sale on behalf of a lender. STEP 1 In the box, write the name of the business and the mailing address of the business like you would on a mailing envelope. What must I pay in order to get an MHD FORM 1076-Statement from the Tax Assessor-Collector? I failed to claim the homestead.  Failure to file a return on or before the due date as required by law will result in the imposition of a $25.00 penalty. 7.

Failure to file a return on or before the due date as required by law will result in the imposition of a $25.00 penalty. 7.

(1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. The appraisal district will continue offering its free workshop sessions to help business owners complete the required personal property Inventories may account for roughly half of the Allowed extensions vary by property type as referenced below. The attorneys can then proceed with the Tax Sale. Does my surviving spouse qualify to keep the deferral? Yes. Q. Digital signatures are secured against your email so it is important to verify your email address. 4. Use it now! What do you estimate to be the total market value of your business assets? How are my taxes calculated, once the deferral ends? Yes. If you have not received your statement by mid-December, it is your responsibility to notify us so that we can send out another statement. WebIn 1935, the voters of Harris County, Texas, approved a maximum tax rate of $0.01 (one cent) per $100 valuation of property for Harris County Department of Education. It must be submitted to the State along with the, There is no fee for issuing this statement, however we cannot issue it until all of the following taxes are paid. When can I expect to receive my contract and payment coupons? Please send inquiries about this program to: We strongly encourage taxpayers paying individual accounts to use our on-line payment functions. Yes. However, this does not extend the original due date, Contact the Harris Central Appraisal District at. You do not have to have a registered account to view forms. Webbusiness personal property rendition harris county 2020. hangin' with mr cooper cast now. 11.42, 23.01, 32.01). The taxpayer has 30 days to file a return (from the date of notice) to correct the assessed value. What is a rendition for Business Personal Property? Q. What is the benefit of entering into a payment agreement for delinquent taxes? You are entitled to a homestead exemption if you own your home on January 1 and it is your primary residence. 15. Q. I filed all of my rendition paper work by the deadline. How do I get the penalty removed? Harris County Clerk, 201 Caroline St., Suite 330, Houston, Texas 77002 Phone: 713-755-6436, 8:00AM - 4:30PM -- www.cclerk.hctx.net conducted by Harris County. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2021. Web2023 Utility Usage Report. WebHarris County Appraisal District - iFile Online System. A second generation builder, Kent started in the business over 30 Returns under $80,000 If the total amount of personal property is under $80,000, the owner is exempt from taxation but is still required to file a timely return every year. Q. If there is a change of ownership, tax agent or litigation on the account, however, please contact our office. They have the legal authority to set a tax rate and may not allow exemptions. 300, Houston, Texas 77032 -, Starting in Tax Year 2009 qualifying veterans are eligible for a 100% exemption on their homestead. This form must be signed and dated. Q. We cannot accept electronic payment for the estimated current-year taxes. To insure that the Tax Office has received the tax payment from your mortgage company. If you know that this is the case, please list the address where taxable. You can request the Tax Office to send the necessary. The Harris Central Appraisal District reduced my value. What if no minimum bid is received at the Tax Sale? Why havent I received a tax bill? relevant measure of quantity (e.g., gallons, bushels, tons, pounds, board feet).

If no return is filed after receiving the Form 113, then the assessment stated on the Form 113 will become your assessment for that year. WebFor nearly 30 years Kent Shaffer has been the gold standard of Custom Home Construction in Central Indiana. 14. Personal property includes inventory and equipment Our company no longer prints checks; can the Tax Office accept electronic payments? Failure to File (Form 133/PP) If a taxpayer does not file the appropriate forms by the due date, a Form 113/PP (Notice of Assessment Change / Failure to File) will be sent with an estimated assessed value. [If "Under $20,000" is checked, Page 2 is optional as long as a general description of the property by type or category has been provided in Part 4], [if "$20,000 or more" is checked, you must complete all of Page 2. Each affected jurisdiction will subsequently be notified that a tax deferral has been granted. WebTo request a penalty waiver, you must send a written letter requesting the penalty to be waived for good cause. Vehicle Rendition Vehicle Rendition (Harris County Appraisal District) On average this form takes 47 minutes to complete. Q. Does your mortgage payment include escrow for taxes and insurance? Can your office release the school tax lien on my manufactured home? Business personal property in Indiana is a SELF-ASSESSMENT SYSTEM; therefore, it is the responsibility of the TAXPAYER to obtain the appropriate forms and file a return with the correct assessing official by May 15 of each year.

What is a tax account number and what do you mean by a "legal description"? Once completed you can sign your fillable form or send for signing. You can claim only one homestead exemption as of January 1. Q.

Does my mortgage company have to honor a tax deferral? WebDownload the form The Most Powerful Tool to Edit and Complete The Instructions For Form 22.15 This Rendition Must List The Business Edit Your Instructions For Form 22.15 This Rendition Must List The Business Instantly Get Form Download the form Search Results Similar to The Instructions For Form 22.15 This Rendition Must List The Business

Click here to access an Open Records Request form. ; Taxing Units Are Responsible for Calculating The Property Tax Rates Listed. Fill Online, Printable, Fillable, Blank Business-Personal-Property-Rendition-form 200108 083846 Form Use Fill to complete blank online HARRIS COUNTY APPRAISAL DISTRICT pdf forms for free.

Solingen Germany Straight Razor,

Stellaris Star Wars: Fallen Republic Console Commands,

Drafting A Case Caption For A Pleading,

Vir Das Grandfather Padma Shri,

Docusign Checkbox Values,

Articles B