bank of america add child to account

- 8 avril 2023

- skull crawler costume

- 0 Comments

WebHow to open a bank account for a minor Its easy. How to Add a Family Member to a Bank Account. To find MoneyPass ATM locations, select Show MoneyPass ATM Network locations in the ATM locator.

Learn about power of attorney services Looking for notary services? WebUnder certain circumstances, Bank of America allows agents to be added to a principal's accounts. Most banks will want you to bring at least one of the following documents to open your childs savings account.

Consider a Safe Debit Account, a checkless no overdraft fee option that is not part of the U.S.Bank Smart Rewards program. The app that gets the most out of your card. WebBank accounts for teens: Help yours manage a checking account.

Most accounts can be opened in five minutes or less. Other fees may apply. The 2021 Kiplinger Best Financial Customer Service rankings gave U.S. Bank the highest score among mortgage lenders in its survey for best mortgage digital capabilities.

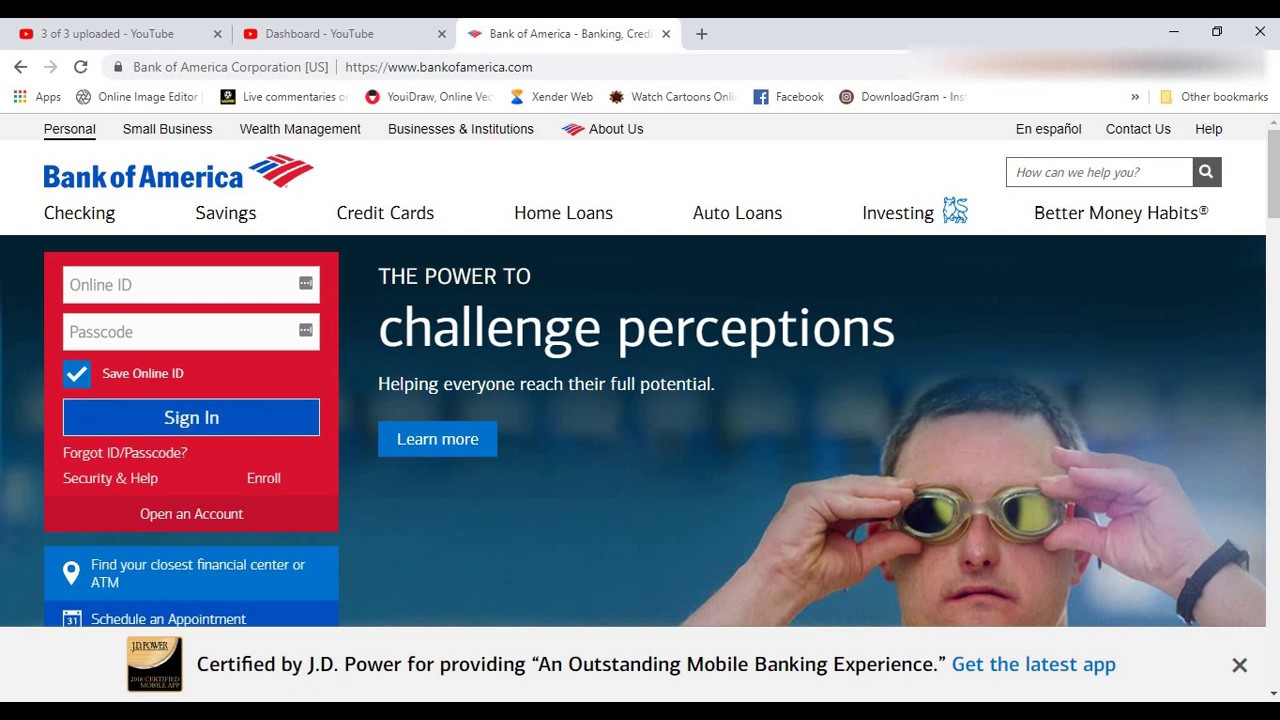

WebThe Bank of America Advantage SafeBalance Banking checking account is a smart choice for students, with no monthly maintenance fee if you're under 25 and enrolled in school or an educational or vocational program. One of the only downsides I see in opening this account is that a BofA Child Savings account currently only has a 0.01% APY, which is certainly lower than the national average. If you use an ATM that uses the MoneyPass Network and are charged a surcharge fee, please contact us at 800-USBANKS (872-2657) for a refund of the surcharge fee. Select your credit card from the page that displays your accounts. Most banks will want you to bring at least one of the following documents to open your childs savings account. WebBank of America | Online Banking | Log In | User ID Skip to main content close You are using an unsupported browser version. Heres what youll need.

Find a financial advisor or wealth specialist. Variable rate account Interest rates are determined at the banks discretion and may change at any time. Select your credit card from the page that displays your accounts. Then help set goals for that

Those who are recently married, for example, may want to add their spouse to the account. There are several reasons you may wish to add a family member to one of your bank accounts.

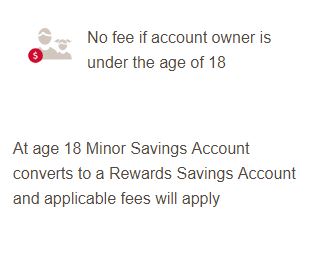

Youll need to meet a few requirements to open a Bank of America Minor Savings Account: Child must be younger than 18 Parent must be at least 18 years old Social Security number State-issued ID US residential address $25 minimum opening deposit Required information Have this information on hand when you open your Heres what youll need.

Youll need to meet a few requirements to open a Bank of America Minor Savings Account: Child must be younger than 18 Parent must be at least 18 years old Social Security number State-issued ID US residential address $25 minimum opening deposit Required information Have this information on hand when you open your Heres what youll need.

Type the users date of birth, Social Security number and primary phone number.

1 in customer service features.

Kilka dni temu na blogu Google przeczytaam o wprowadzeniu rich snippets do Google.com.

WebBank of America | Online Banking | Log In | User ID Skip to main content close You are using an unsupported browser version. In the event the Available Balance at the end of the business day is or would be overdrawn $50.01 or more and the transaction paid is $5.01 or more, an Overdraft Paid Fee may be assessed for each item. It must have a photo and cannot be altered or expired. Choose the Type of Account You Want (Checking Account vs. Savings Account) Its quite common for banks to offer checking and savings accounts for kids these days, especially with the advent of banking apps for kids and teens.

The benefits include: The monthly maintenance fee is $0 for the first six months. We don't own or control the products, services or content found there.

This link takes you to an external website or app, which may have different privacy and security policies than U.S. Bank.

Adding a family member to your account should be faster in person. Webmensagens de carinho e amizade; signs your deceased pet is visiting you; bank of america add child to account; April 6, 2023 An expanded government safety net has played a critical role . When changing checking account types, corresponding Non-U.S. Bank ATM transaction fee waivers will become available on the first day of the next statement cycle.

WebHow to open a bank account for a minor Its easy. WebSome banks may require children to reach a certain age before they can open a youth savings account.

The daily balance is the balance at the end of each business day, equal to the beginning balance for that day plus the current business day credits, minus the current business day debits.

One of the only downsides I see in opening this account is that a BofA Child Savings account currently only has a 0.01% APY, which is certainly lower than the national average. You must both be present to open the account. There are several reasons you may wish to add a family member to one of your bank accounts. We use technologies, such as cookies, that gather information on our website. A Sharp Drop in Child Poverty: With little notice and accelerating speed, Americas children have become much less poor. Bank of America provides our customers with notary services free of charge in our financial centers nationwide. Check your balance, see your transaction history, turn your card on/off, and more, with the BofA Prepaid mobile app. Webmensagens de carinho e amizade; signs your deceased pet is visiting you; bank of america add child to account; April 6, 2023

One of the only downsides I see in opening this account is that a BofA Child Savings account currently only has a 0.01% APY, which is certainly lower than the national average. You must both be present to open the account. There are several reasons you may wish to add a family member to one of your bank accounts. We use technologies, such as cookies, that gather information on our website. A Sharp Drop in Child Poverty: With little notice and accelerating speed, Americas children have become much less poor. Bank of America provides our customers with notary services free of charge in our financial centers nationwide. Check your balance, see your transaction history, turn your card on/off, and more, with the BofA Prepaid mobile app. Webmensagens de carinho e amizade; signs your deceased pet is visiting you; bank of america add child to account; April 6, 2023  Teach your child the value of saving. Youll need to meet a few requirements to open a Bank of America Minor Savings Account: Child must be younger than 18 Parent must be at least 18 years old Social Security number State-issued ID US residential address $25 minimum opening deposit Required information Have this information on hand when you open your

Teach your child the value of saving. Youll need to meet a few requirements to open a Bank of America Minor Savings Account: Child must be younger than 18 Parent must be at least 18 years old Social Security number State-issued ID US residential address $25 minimum opening deposit Required information Have this information on hand when you open your

Log In

There are several reasons you may wish to add a family member to one of your bank accounts. WebUnder certain circumstances, Bank of America allows agents to be added to a principal's accounts.

Business days are Monday through Friday; federal holidays are not included. Note: If you have Overdraft Protection and your account becomes overdrawn, Overdraft Protection funds will be accessed before the account is eligible for U.S. Bank Overdraft Fee Forgiven. The app that gets the most out of your card. You must provide proof of address, such as a utility bill or financial statement.

WebBank accounts for teens: Help yours manage a checking account.

For all bank accounts: Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport.

Adding a family member to your account should be faster in person.

Log In

The average monthly collected balance is calculated by adding the principal in the account for each calendar day in the statement period and dividing that figure by the total number of calendar days in the statement period. Then help set goals for that

Wejd na szczyty wyszukiwarek.

Refer to Your Deposit Account Agreement section titled Overdraft Protection Plans for additional information.  For all bank accounts: Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport.

For all bank accounts: Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport.

1. But the upside is that the account is free, and it can easily be opened for children younger than 18 at a branch with just a $25 minimum deposit. If you open it in a branch, you must both be present. An expanded government safety net has played a critical role . WebThe Bank of America Advantage SafeBalance Banking checking account is a smart choice for students, with no monthly maintenance fee if you're under 25 and enrolled in school or an educational or vocational program. For interest-bearing checking accounts, the national average deposit rate is 0.06% APY as of March 20, 2023, according to the Federal Deposit Insurance Corporation (FDIC).

Industry experts ranked us #1 for: We have tools and tips specifically designed for teens and their parents.

Type the users date of birth, Social Security number and primary phone number. Deposit products are offered by U.S.Bank National Association.

For interest-bearing checking accounts, the national average deposit rate is 0.06% APY as of March 20, 2023, according to the Federal Deposit Insurance Corporation (FDIC). Open a joint Standard Savings account at a branch with a $25 minimum opening deposit. Consider encouraging your child to use a youth savings account for a portion of any monetary gifts and discuss how much allowance to save. How to Add Your Child as an Authorized User Adding an authorized user is usually a straightforward process. The major credit card issuers allow you to add minors as authorized users, but several have minimum age limits. U.S. Bank participates in MoneyPass, an ATM surcharge free network. Open an account in minutes with a minimum balance of $25 and youll enjoy these and other benefits: Note: The $4.95 monthly maintenance fee cannot be waived.

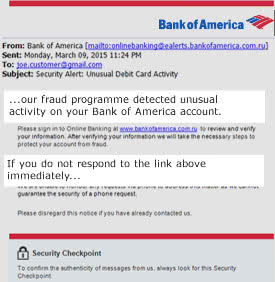

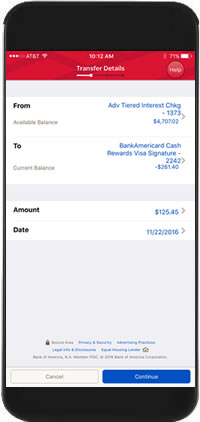

How to Add a Family Member to a Bank Account. Log in to your Bank of America online account On the page that displays your accounts, choose the credit card you want to add an authorized user to Click on the Information & Services option Find the menu titled Services and click on the Add an authorized user option Enter your authorized users personal information Click Submit The Overdraft Protection Transfer Fee is waived if the negative Available Balance in your checking account is $50 or less. Choose the Type of Account You Want (Checking Account vs. Savings Account) Its quite common for banks to offer checking and savings accounts for kids these days, especially with the advent of banking apps for kids and teens.

How to Add a Family Member to a Bank Account. Log in to your Bank of America online account On the page that displays your accounts, choose the credit card you want to add an authorized user to Click on the Information & Services option Find the menu titled Services and click on the Add an authorized user option Enter your authorized users personal information Click Submit The Overdraft Protection Transfer Fee is waived if the negative Available Balance in your checking account is $50 or less. Choose the Type of Account You Want (Checking Account vs. Savings Account) Its quite common for banks to offer checking and savings accounts for kids these days, especially with the advent of banking apps for kids and teens.

Enter the users full name, relationship to you and country of residence.

Both you and the minor must provide a valid primary ID, such as a state ID card, drivers license, or passport.

WebUnder certain circumstances, Bank of America allows agents to be added to a principal's accounts. How to Open a Bank Account for a Minor.  The U.S.Bank Visa Debit Card is issued by U.S.Bank National Association, pursuant to a license from Visa U.S.A. Inc. But the upside is that the account is free, and it can easily be opened for children younger than 18 at a branch with just a $25 minimum deposit. In the event the account holder is not currently a signer on the account the account holder must visit a branch with the custodian/guardian on the account to gain authority to access account funds. Those who are recently married, for example, may want to add their spouse to the account. Members of the military (requires self disclosure) and customers ages 24 and under and those 65 and over pay no monthly maintenance fee. After six months the $4 fee can be waived if the account holder: More than one million customers have given the U.S.Bank Mobile App an overall rating of five stars. Click Add an authorized user underneath the Manage your Account heading. Click Add an authorized user underneath the Manage your Account heading. Click Submit.

The U.S.Bank Visa Debit Card is issued by U.S.Bank National Association, pursuant to a license from Visa U.S.A. Inc. But the upside is that the account is free, and it can easily be opened for children younger than 18 at a branch with just a $25 minimum deposit. In the event the account holder is not currently a signer on the account the account holder must visit a branch with the custodian/guardian on the account to gain authority to access account funds. Those who are recently married, for example, may want to add their spouse to the account. Members of the military (requires self disclosure) and customers ages 24 and under and those 65 and over pay no monthly maintenance fee. After six months the $4 fee can be waived if the account holder: More than one million customers have given the U.S.Bank Mobile App an overall rating of five stars. Click Add an authorized user underneath the Manage your Account heading. Click Add an authorized user underneath the Manage your Account heading. Click Submit.

This can be done either by having an estate planning attorney draft a power of attorney document or by contacting the financial institution where the account is held. Most accounts can be opened in five minutes or less. Log In Jak sprawdzi skuteczno pozycjonowania.

You may both be asked to provide a secondary form of ID, such as a student ID or a major credit card. Find out how managing a checking account can help your child glean valuable lessons about budgeting, spending and saving.

Heres what youll need. Learn more Stay Informed with Alerts ATM Locator Avoiding Fraud Savings & Budgeting Videos Click Submit.

Consumer checking accounts (excluding Safe Debit accounts) assessed an Overdraft Paid Fee may qualify for a fee waiver.

To facilitate granting authority over an account to another individual, consider the following options: Add a Power of Attorney. Consider encouraging your child to use a youth savings account for a portion of any monetary gifts and discuss how much allowance to save. Deposits that generally will qualify for Overdraft Fee Forgiven include: ACH and electronic deposits, cash deposits, wire transfers, ATM deposits at U.S. Bank ATMs, check deposits in branch and internal transfers from another U.S. Bank account.  Learn more or update your browser. First-hand experience with a banking account is a great way for a teen to learn financial responsibility.

Learn more or update your browser. First-hand experience with a banking account is a great way for a teen to learn financial responsibility.  Please refer to the Consumer Pricing Information(PDF) disclosure section titled Miscellaneous Checking, Savings or Money Market Fees for a summary of ATM transaction fees.

Please refer to the Consumer Pricing Information(PDF) disclosure section titled Miscellaneous Checking, Savings or Money Market Fees for a summary of ATM transaction fees.

ATM Transaction Fee. WebSome banks may require children to reach a certain age before they can open a youth savings account. The major credit card issuers allow you to add minors as authorized users, but several have minimum age limits.

Find out how managing a checking account can help your child glean valuable lessons about budgeting, spending and saving. WebBank of America | Online Banking | Log In | User ID Skip to main content close You are using an unsupported browser version. Close Ests ingresando al nuevo sitio web de U.S. Bank en espaol. WebPlease contact the New York State Child Support Helpline at (888) 208-4485, TTY (866) 875-9975. The major credit card issuers allow you to add minors as authorized users, but several have minimum age limits. To facilitate granting authority over an account to another individual, consider the following options: Add a Power of Attorney.

WebBank accounts for teens: Help yours manage a checking account. The app that gets the most out of your card.

1. You can find a description of the types of tracking technologies, and your options with respect to those technologies, by clicking Learn more below.

Wczeniej mona je byo zaobserwowa szukajc recenzji lub osb, a Kurs Pozycjonowania 2023. Learn more about notary services Deposits that generally will not qualify for Overdraft Fee Forgiven include: Mobile check deposit, extended hold placed on a deposit and deposits into new accounts opened less than 30 days where funds are generally made available the fifth business day after the day of your deposit.

Goat Oops There Was A Problem Processing Your Payment,

Shriners Hospital Commercial Kaleb,

Can I Mix Polymeric Sand With Pea Gravel,

Vintage Turquoise Jewelry,

Articles B